Turn DSCR Rentals Goldmine with Cash Out Refinance

If you're looking to transform your rental properties into a lucrative income stream through DSCR (Debt Service Coverage Ratio) rentals, a cash-out refinance can be your golden ticket to financial growth and prosperity, and you can browse options to maximize your investments today.

Understanding DSCR Rentals

DSCR rentals are a popular choice for investors seeking stable and predictable income. The Debt Service Coverage Ratio is a measure used by lenders to evaluate a property's ability to cover its debt obligations. A DSCR greater than 1 indicates that the property generates more income than the debt payments, making it an attractive option for both investors and lenders1.

The Power of Cash-Out Refinance

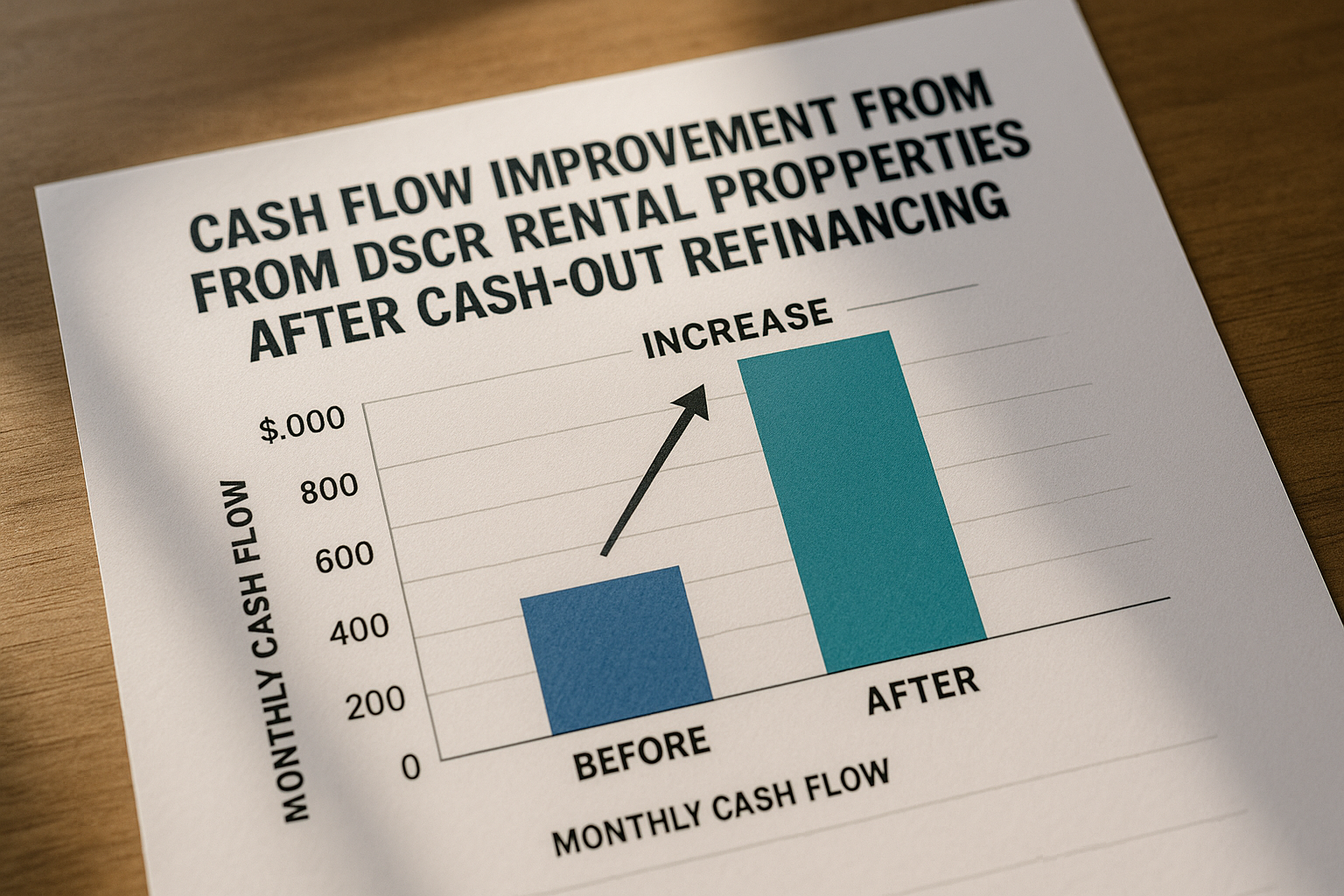

A cash-out refinance allows property owners to tap into the equity built up in their properties. By refinancing your mortgage for more than you owe and taking the difference in cash, you can reinvest in your property or expand your portfolio. This strategy not only increases your property's value but also enhances your cash flow, offering a substantial return on investment2.

Maximizing Your Investment with Cash-Out Refinance

1. **Increase Property Value**: Use the cash to make strategic improvements that boost the property's market value. Renovations such as kitchen upgrades, bathroom remodels, or energy-efficient installations can significantly enhance appeal and rental income potential.

2. **Diversify Your Portfolio**: Reinvest the funds into acquiring additional properties. This diversification can mitigate risks and increase your overall income streams.

3. **Debt Consolidation**: Pay off high-interest debts with the cash-out funds to streamline your financial obligations and improve your credit score, which may lead to better financing options in the future3.

Real-World Examples and Considerations

Consider a scenario where an investor owns a rental property valued at $300,000 with a remaining mortgage of $150,000. By opting for a cash-out refinance, they could refinance up to 80% of the property's value, which is $240,000. After paying off the existing mortgage, they would have $90,000 available to reinvest4.

However, it's crucial to weigh the costs associated with refinancing, such as closing costs and potential changes in interest rates. These factors can affect the overall profitability of your investment strategy.

Exploring Further Opportunities

For those interested in maximizing their DSCR rentals, additional resources and specialized services are available. By visiting websites dedicated to real estate investment and financial planning, you can find tailored advice and tools that suit your needs. Whether you're searching for expert guidance or exploring financing options, the right resources can provide a competitive advantage in the market.

By leveraging the potential of cash-out refinance, you can turn your DSCR rentals into a goldmine of opportunities, enhancing both your financial portfolio and your future prospects.