Texas Habitation Buildings Hidden Insurance Options Revealed

Unlocking the hidden potential of Texas habitation buildings' insurance options can not only save you money but also provide peace of mind, so why not browse options and see these opportunities for yourself?

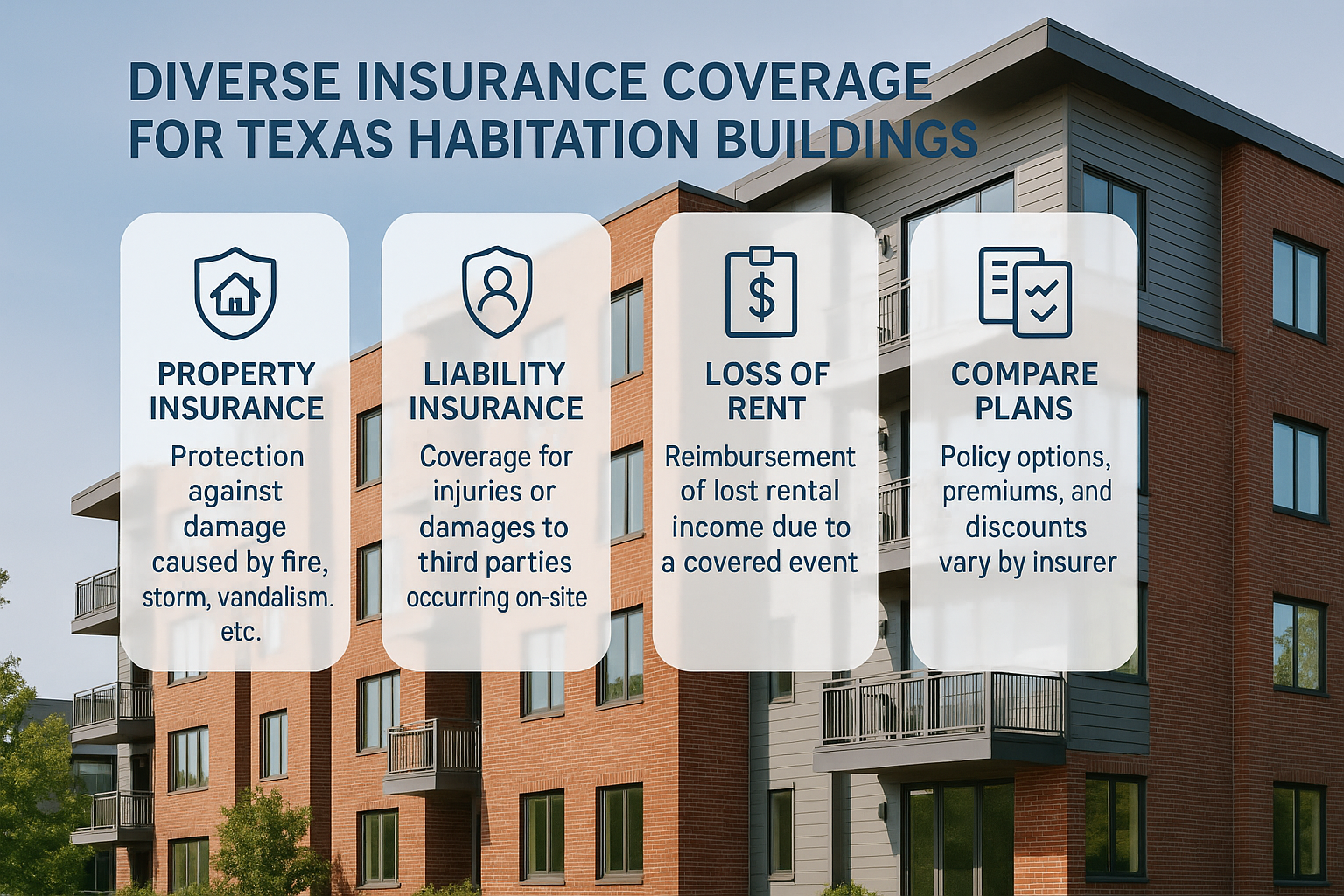

Understanding Texas Habitation Buildings Insurance

In the vast landscape of insurance policies, habitation buildings insurance in Texas stands out as a crucial yet often overlooked necessity. It is specifically designed for properties that are rented out to tenants, covering everything from apartment complexes to multi-family homes. This type of insurance is essential for landlords who want to protect their investment from unforeseen events such as fires, storms, or liability claims. Understanding the nuances of these policies can significantly impact your financial security and operational efficiency.

Key Benefits of Habitation Insurance

One of the primary benefits of habitation insurance is its comprehensive coverage. It typically includes protection for the building structure, liability coverage, and often loss of rental income. This means that in the event of damage that renders the property uninhabitable, landlords can still maintain their cash flow through insurance payouts. Additionally, liability coverage protects against legal claims if someone is injured on the property, which is a significant consideration given the litigious nature of today's society.

Exploring Hidden Insurance Options

Many landlords are unaware of the hidden insurance options available to them, which can lead to overpaying for inadequate coverage. For instance, some insurers offer discounts for properties equipped with modern safety features like fire alarms and sprinkler systems. Additionally, bundling policies, such as combining habitation insurance with other types of coverage like general liability or umbrella policies, can lead to significant cost savings. By taking the time to search options and visit websites of different insurance providers, landlords can uncover these hidden gems and optimize their insurance strategy.

The Cost Factor

The cost of habitation insurance in Texas varies widely based on factors such as location, building size, and the chosen coverage limits. On average, landlords can expect to pay between $500 to $1,500 annually per unit, though this can fluctuate based on specific circumstances1. It is advisable to obtain multiple quotes and compare them to ensure you're getting the best deal. Some insurers may offer introductory discounts or loyalty savings for long-term customers, so it's worth investigating these possibilities.

Real-World Considerations

When selecting an insurance policy, it's crucial to consider the unique risks associated with your property. For example, properties located in flood-prone areas might require additional flood insurance, which is not typically covered under standard habitation policies2. Similarly, if your property is in a region prone to hurricanes, windstorm coverage might be necessary. Being aware of these specific needs and tailoring your insurance policy accordingly can prevent costly oversights.

Making the Most of Your Insurance

To maximize the benefits of your habitation insurance, it's important to regularly review and update your policy. Changes in property value, tenant occupancy, or local regulations can all necessitate adjustments to your coverage. Additionally, maintaining an open line of communication with your insurance provider can ensure that you are always aware of new options and potential savings.

By exploring the hidden insurance options available for Texas habitation buildings, landlords can secure comprehensive protection while optimizing costs. Whether you choose to browse options or visit websites for detailed comparisons, taking proactive steps in managing your insurance can lead to substantial benefits and peace of mind.