Skyrocket Your Coverage With Senior Living Insurance Secrets

Unlock the secrets to maximizing your senior living insurance coverage by exploring tailored options that can enhance your peace of mind and financial security—browse options now to discover the best solutions for your needs.

Understanding Senior Living Insurance

Senior living insurance is a crucial tool for those planning their retirement years, offering financial protection and peace of mind. This specialized insurance can cover various aspects of senior care, including assisted living, nursing home care, and in-home support, ensuring that you or your loved ones receive the necessary care without depleting savings. As the cost of senior care continues to rise, having comprehensive coverage is more important than ever. According to Genworth's 2021 Cost of Care Survey, the median annual cost for assisted living is $54,000, a figure expected to increase in the coming years1.

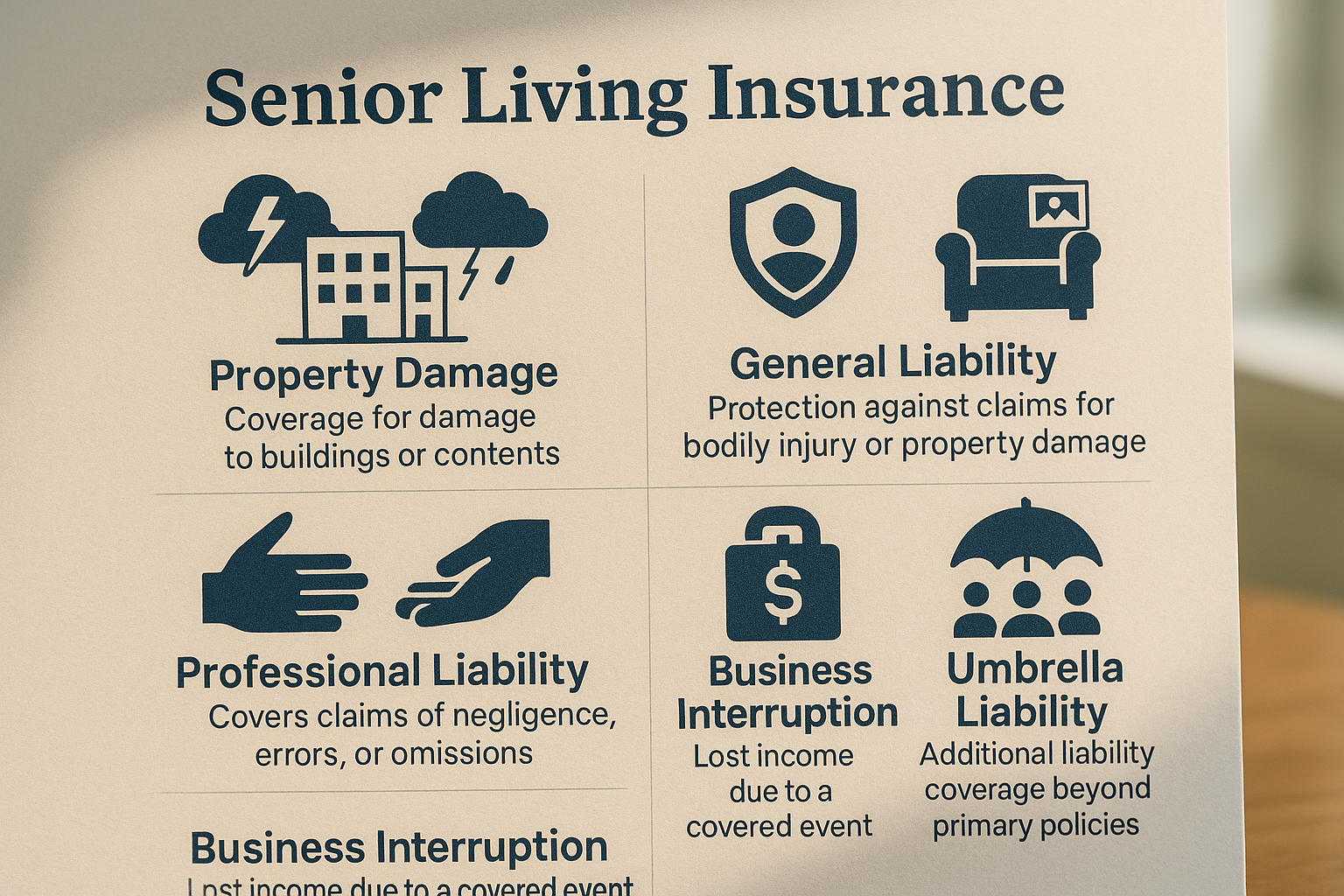

Types of Senior Living Insurance

There are several types of senior living insurance options available, each designed to meet different needs:

1. **Long-Term Care Insurance**: This policy typically covers expenses related to assisted living, nursing home care, and in some cases, in-home care. It is essential to purchase this insurance when you are still in good health, as premiums are lower and coverage options are more comprehensive.

2. **Life Insurance with Long-Term Care Riders**: Some life insurance policies offer riders that can be used to cover long-term care expenses. This option allows policyholders to use a portion of their death benefit for care costs, providing flexibility and added security.

3. **Hybrid Policies**: These are a combination of life insurance and long-term care insurance. They offer the benefits of both types of policies and are becoming increasingly popular due to their flexibility and comprehensive coverage.

Benefits of Senior Living Insurance

Investing in senior living insurance offers numerous benefits:

Financial Security**: Protects your savings and assets from being depleted by high care costs.

- **Comprehensive Coverage**: Offers a wide range of care options, ensuring you receive the appropriate level of support.

- **Peace of Mind**: Provides reassurance that you or your loved ones will be cared for in the event of illness or disability.

- **Tax Advantages**: Premiums for long-term care insurance may be tax-deductible, depending on your policy and location2.

Evaluating Costs and Coverage

When considering senior living insurance, it's important to evaluate the costs and coverage options carefully. Premiums can vary significantly based on factors such as age, health status, and the level of coverage chosen. On average, the annual premium for a long-term care insurance policy for a healthy 55-year-old is approximately $2,050 for a single individual3.

Exploring Your Options

To make an informed decision, it's essential to compare different insurance providers and policies. Visit websites of well-known insurers to understand the specific benefits they offer and to get quotes tailored to your needs. Additionally, consulting with a financial advisor can provide valuable insights into the best options for your situation.

Senior living insurance is a vital component of retirement planning, offering protection and peace of mind. By understanding the various options available and evaluating your specific needs, you can secure a policy that ensures you or your loved ones receive the necessary care without financial strain. Follow the options available to find the best coverage and start planning for a secure future today.