Secure Exclusive Commercial Auto Insurance Quote Today

Secure your business's future by exploring exclusive commercial auto insurance options today to ensure you're protected and prepared for whatever the road ahead might bring.

Understanding Commercial Auto Insurance

Commercial auto insurance is designed to cover vehicles used for business purposes, offering protection against potential liabilities that could arise from accidents or other incidents. Whether you own a small business with a single delivery van or manage a fleet of trucks, securing the right insurance policy is crucial for safeguarding your assets and ensuring uninterrupted operations. This type of insurance typically covers property damage, bodily injury, and medical payments, among other liabilities.

Why You Need Commercial Auto Insurance

The primary reason for obtaining commercial auto insurance is to protect your business from significant financial loss. Accidents happen, and without adequate coverage, your business could be liable for costly repairs, medical bills, and legal fees. Moreover, many states require businesses to carry a minimum level of insurance, making it not just a smart decision but a legal necessity1.

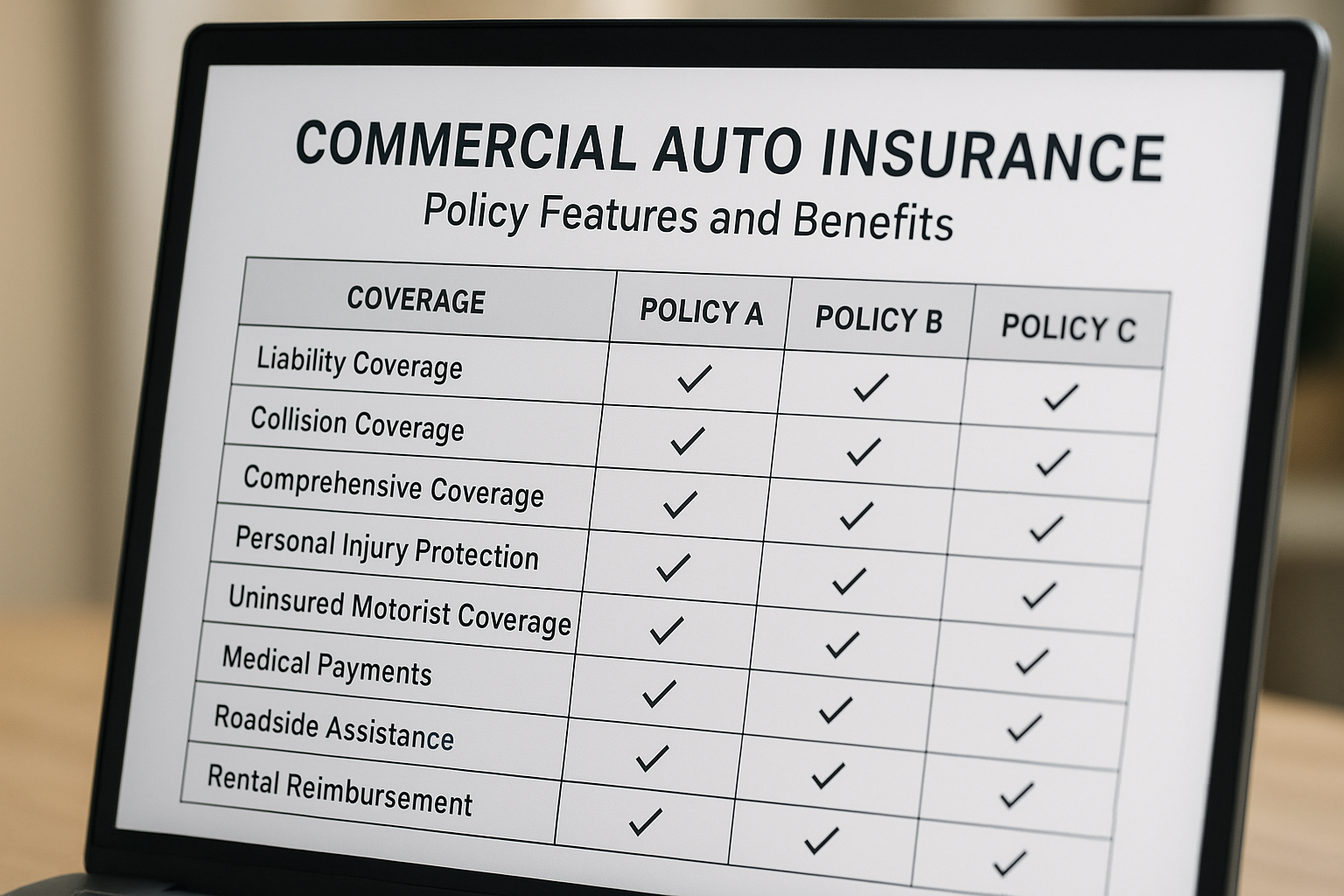

Types of Coverage Available

Commercial auto insurance offers several types of coverage options:

- Liability Coverage: Covers damages and injuries to others if you're at fault in an accident.

- Collision Coverage: Pays for damage to your vehicle from collisions, regardless of fault.

- Comprehensive Coverage: Protects against non-collision-related incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who lacks sufficient insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident.

Factors Affecting Premiums

Several factors influence the cost of commercial auto insurance premiums:

According to industry reports, businesses can often find discounts by bundling policies or maintaining a good safety record2.

How to Secure an Exclusive Quote

To secure an exclusive commercial auto insurance quote, start by assessing your specific needs and risks. Consider the number of vehicles, their usage, and the level of coverage required. Once you have a clear understanding, you can browse options by visiting websites of reputable insurance providers. Many offer online quote tools that allow you to compare coverage and pricing easily.

It's also beneficial to consult with an insurance broker who can provide personalized advice and help you find the best deals. Brokers often have access to exclusive offers and can negotiate on your behalf3.

Maximizing Your Insurance Benefits

To get the most out of your commercial auto insurance, regularly review your policy to ensure it meets your evolving business needs. Stay informed about new insurance products and industry trends that could offer better protection or savings. Engaging with insurance experts and leveraging their insights can lead to substantial benefits and peace of mind4.

In summary, securing the right commercial auto insurance is a critical step in protecting your business. By understanding your coverage options and actively seeking competitive quotes, you can ensure that your business is well-prepared for any challenges on the road. Explore these options to find the best fit for your business needs.