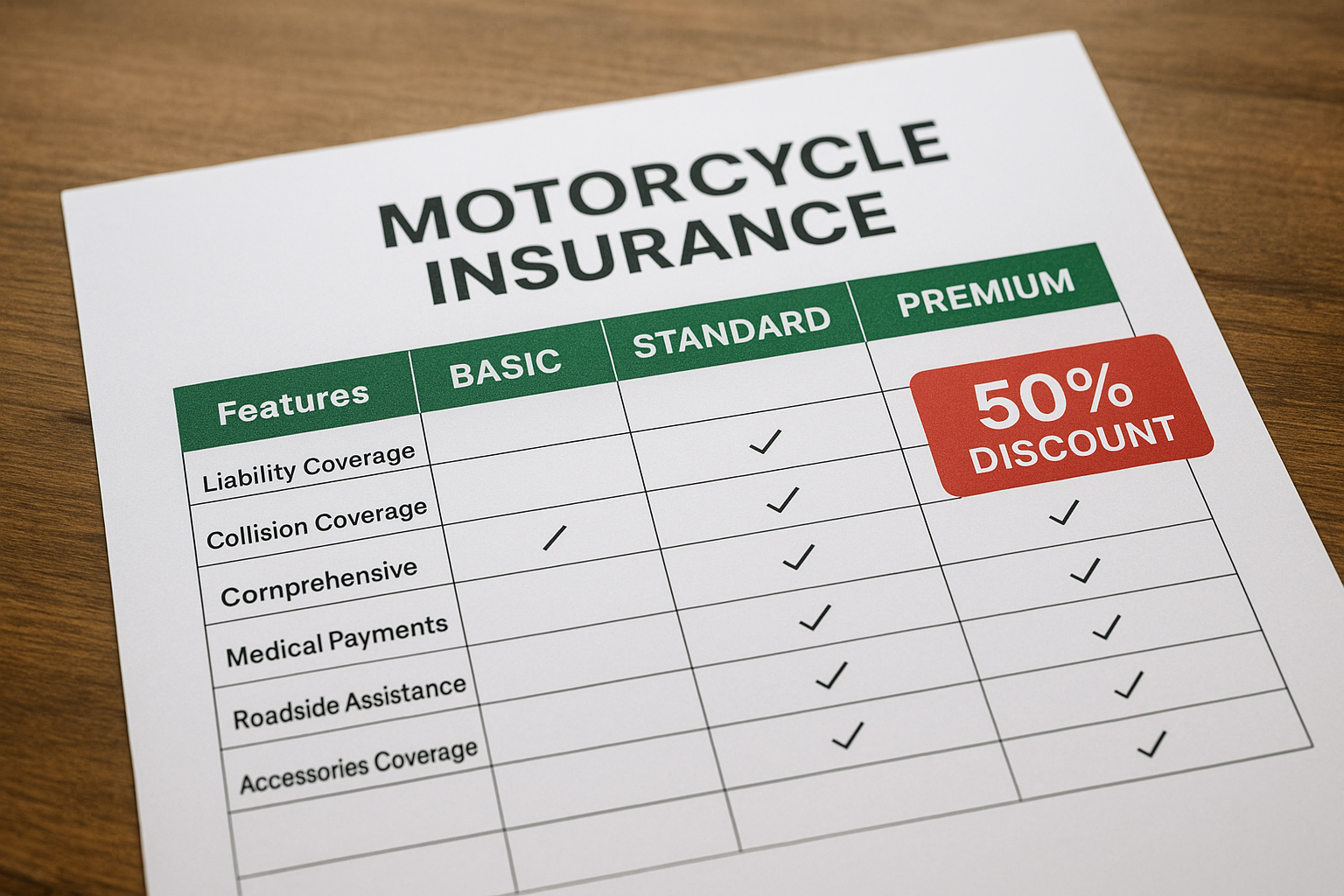

Secret Savings Motorcycle Insurance Coverage Comparison Reveals 50% Discounts

Imagine slashing your motorcycle insurance costs by half while ensuring you’re fully covered by simply taking the time to browse options and compare plans.

The Secret to Saving Big on Motorcycle Insurance

Motorcycle enthusiasts often face the challenge of finding affordable yet comprehensive insurance coverage. With the right approach, you can uncover significant savings without compromising on the protection you need. The key lies in understanding the various coverage options available and taking advantage of the competitive market to find the best deals.

Understanding Motorcycle Insurance Coverage

Motorcycle insurance typically includes several types of coverage: liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments. Liability insurance is mandatory in most states and covers damages to others if you’re at fault in an accident. Collision and comprehensive coverages protect your bike against accidents and other damages such as theft or natural disasters. Uninsured/underinsured motorist coverage offers protection if you’re hit by a driver without adequate insurance, and medical payments cover your medical expenses after an accident.

Why Comparing Insurance Plans Matters

Insurance companies offer a wide range of plans with varying premiums and coverage limits. By comparing these options, you can identify policies that offer the best value for your needs. Many insurers provide discounts for factors such as safe driving records, membership in motorcycle organizations, or bundling with other insurance policies. Some companies even offer up to 50% discounts for eligible riders1.

Real-World Savings: What to Expect

According to the Insurance Information Institute, the average cost of motorcycle insurance in the U.S. is approximately $519 per year2. However, by leveraging discounts and comparing plans, many riders report paying significantly less. For instance, safe riders with a clean driving record and a multi-policy discount can see premiums drop to as low as $250 annually3.

Steps to Achieve Maximum Savings

- Assess Your Needs: Determine the type and amount of coverage you require based on your motorcycle usage and personal circumstances.

- Gather Quotes: Use online tools to obtain quotes from multiple insurers. Be sure to compare similar coverage levels to ensure an accurate comparison.

- Look for Discounts: Ask about available discounts and eligibility criteria. Common discounts include those for safety courses, anti-theft devices, and loyalty.

- Review Policy Details: Thoroughly review policy terms to understand coverage limits, exclusions, and deductibles.

- Make an Informed Decision: Choose the policy that offers the best combination of price and protection.

Exploring Specialized Services

For those seeking highly tailored options, specialized insurance brokers can provide personalized advice and access to niche markets that cater specifically to motorcycle riders. These services often reveal exclusive discounts and coverage options not available through standard channels.

By taking the time to explore the various resources available, you can find an insurance policy that meets your needs and budget. Start by visiting websites of reputable insurers and following the options they present to secure the best deal possible.