Save Thousands with Smart Multi-State Insurance for Practices

You could be saving thousands on your practice's insurance by exploring smart multi-state options that offer tailored coverage and competitive pricing, so why not browse options and see how much you could benefit?

Understanding Multi-State Insurance for Practices

Navigating the complexities of insurance for medical practices can be daunting, especially when operating across multiple states. Multi-state insurance offers a streamlined solution by providing a cohesive policy that covers all your practice locations under one umbrella. This approach not only simplifies the management of your insurance needs but can also lead to significant cost savings.

Benefits of Multi-State Insurance

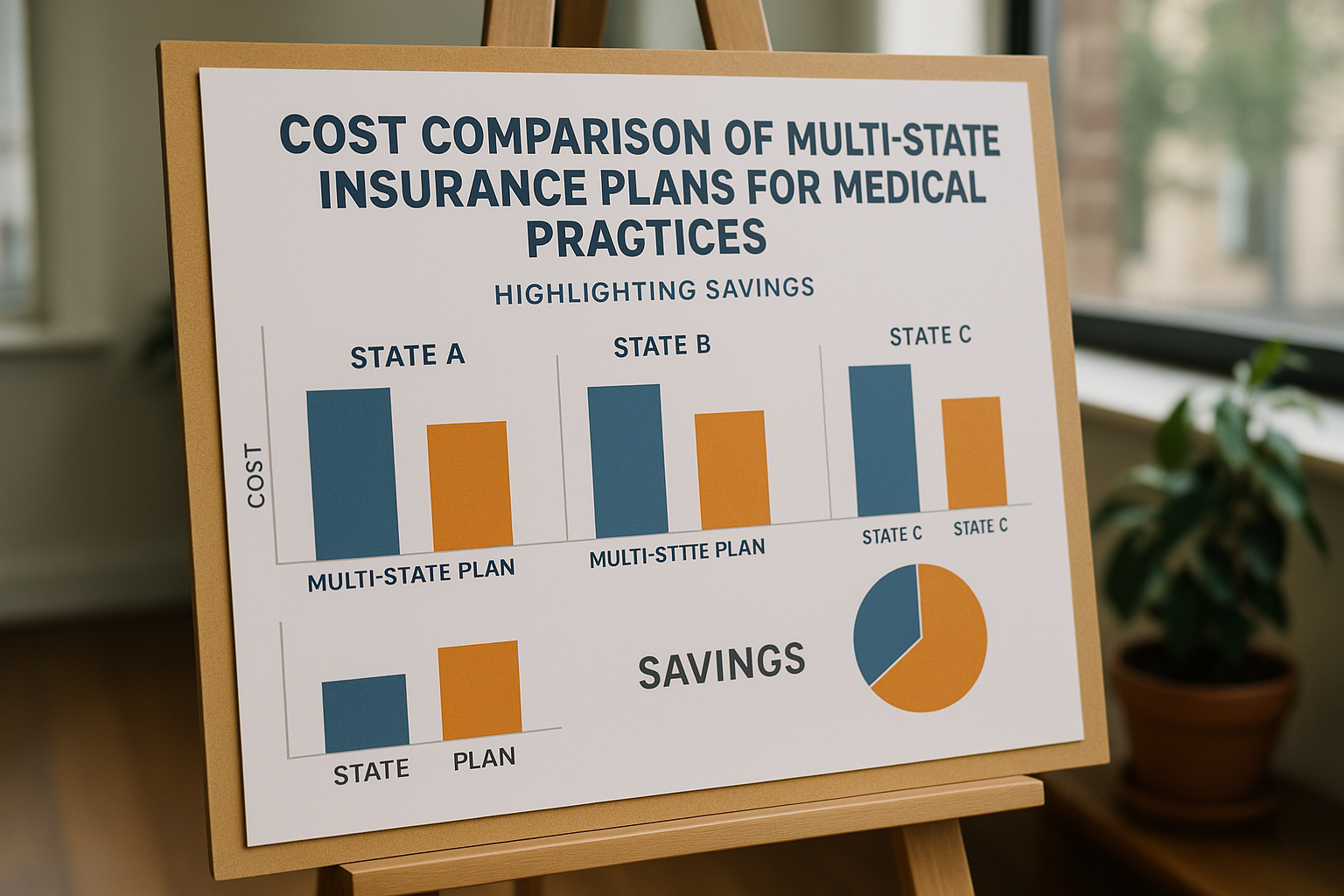

One of the primary advantages of multi-state insurance is the potential for substantial savings. By consolidating your insurance policies, you can often negotiate better rates due to the larger scale of coverage. This is particularly beneficial for practices with multiple locations, as insurers may offer discounts for the increased volume of business1.

Additionally, multi-state insurance can provide consistent coverage levels across all locations, ensuring that you are adequately protected no matter where you operate. This uniformity can reduce the risk of coverage gaps that might occur if separate policies were purchased for each state2.

Financial Implications

The financial benefits of multi-state insurance are not just limited to premium savings. By having a single policy, administrative costs can be reduced significantly. Managing multiple policies can be time-consuming and costly, with different renewal dates, varying terms, and separate contacts for each insurer. A unified policy alleviates these administrative burdens, allowing your practice to focus more on patient care rather than paperwork3.

Moreover, some insurers offer additional discounts for practices that implement risk management programs, further reducing costs. These programs can lower the likelihood of claims, which in turn can lead to lower premiums4.

Exploring Your Options

To fully capitalize on the benefits of multi-state insurance, it's crucial to explore the various options available. Many insurers provide online platforms where you can compare different policies and pricing structures. Taking the time to search options and consult with insurance experts can help you find a policy that aligns with your practice's specific needs and budget.

When evaluating multi-state insurance, consider factors such as the insurer's reputation, the comprehensiveness of coverage, and the flexibility of policy terms. It's also wise to seek feedback from other practices that have successfully implemented multi-state insurance solutions.

Key Considerations

Before committing to a multi-state insurance policy, ensure that you understand the specific regulatory requirements of each state where your practice operates. Insurance regulations can vary significantly, and compliance is crucial to maintaining valid coverage. Working with an insurance provider experienced in multi-state policies can help navigate these complexities.

Furthermore, as your practice grows or changes, regularly review your insurance needs to ensure your coverage remains adequate and cost-effective. Adjusting your policy as necessary can prevent over-insurance or under-insurance, both of which can be costly in the long run.

In summary, multi-state insurance offers a strategic approach to managing your practice's coverage needs, with the potential to save thousands through consolidated policies and reduced administrative burdens. By visiting websites and exploring the various options available, you can find a tailored solution that not only protects your practice but also contributes to its financial health.