Save Big with Retail Chains Insurance Quote Secrets

Unlock the secrets to saving big on retail chains insurance quotes by exploring a wealth of options that can significantly cut your costs and enhance your coverage.

Understanding Retail Chains Insurance

Retail chains insurance is a specialized form of business insurance tailored to meet the unique needs of retail businesses with multiple locations. This type of insurance typically includes coverage for property damage, liability, business interruption, and workers' compensation, among others. Given the complexity and scale of operations in retail chains, having a comprehensive insurance policy is crucial to protect against potential risks and losses.

Insurance for retail chains is not a one-size-fits-all proposition. Each chain has specific needs based on factors such as location, size, and the nature of the goods sold. As a result, insurance providers offer a variety of policy options that can be customized to fit the unique requirements of each business. By understanding these options and how they can be tailored, retail chain owners can ensure they are adequately protected while also finding ways to save on their premiums.

Key Benefits of Retail Chains Insurance

One of the primary benefits of retail chains insurance is financial protection. In the event of a disaster, such as a fire or natural calamity, having the right insurance coverage can mean the difference between a minor setback and a catastrophic loss. Business interruption insurance, for example, can cover lost income during periods when a store must close for repairs, ensuring that the business remains solvent.

Another significant benefit is liability protection. With customers and employees frequenting retail locations, the risk of accidents is ever-present. Liability insurance covers legal fees and settlements if the business is sued for injuries or damages occurring on its premises. This coverage is essential for safeguarding the business's financial health and reputation.

Strategies for Saving on Retail Chains Insurance

To maximize savings on retail chains insurance, consider the following strategies:

- Bundle Policies: Many insurance providers offer discounts for businesses that bundle multiple types of coverage. By combining property, liability, and other policies, retail chains can often secure lower premiums.

- Implement Risk Management Practices: Insurers frequently offer lower rates to businesses that demonstrate proactive risk management. This can include installing security systems, conducting regular safety audits, and training employees on safety protocols.

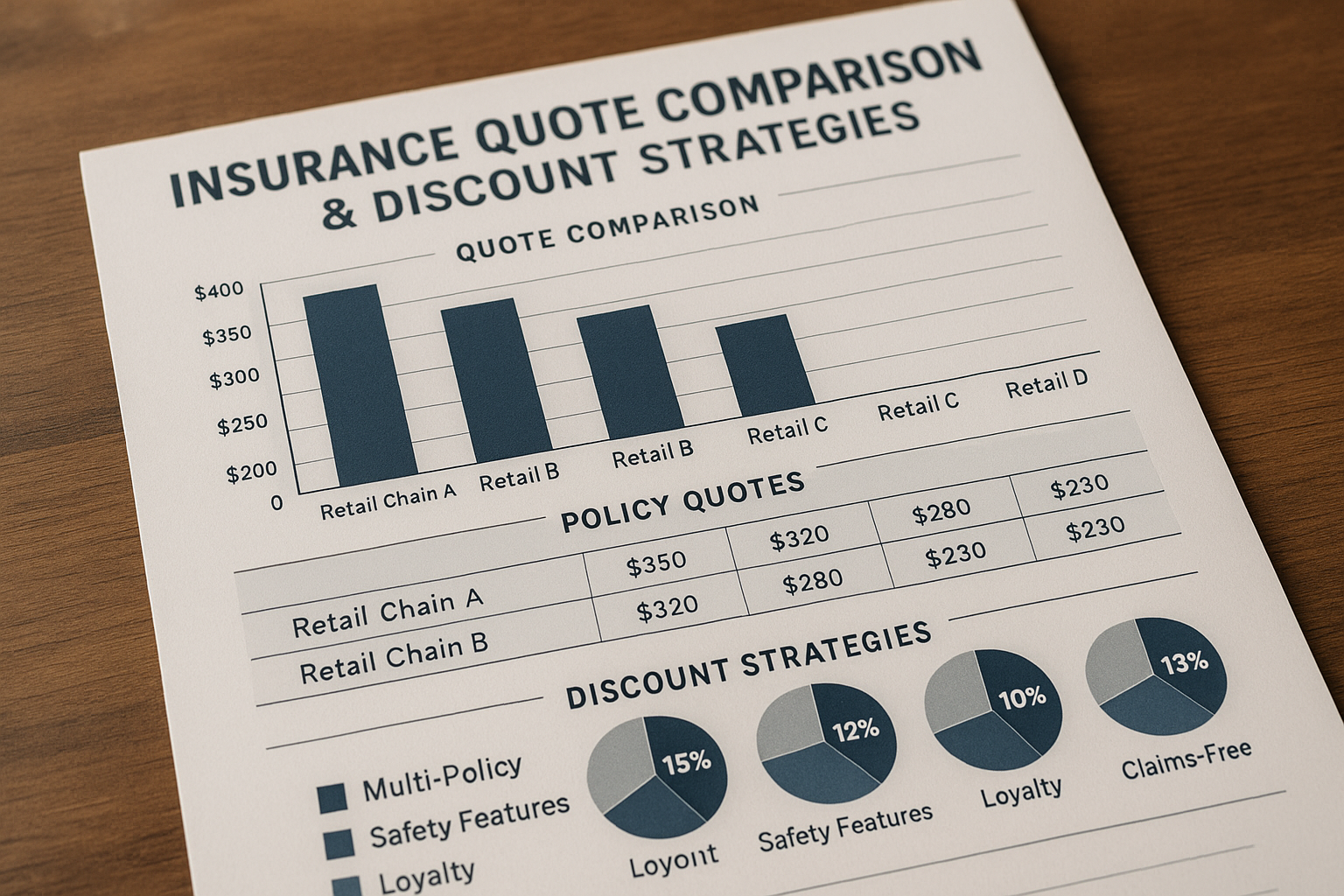

- Shop Around: Different insurers offer varying rates and coverage options. By taking the time to browse options and compare quotes from multiple providers, retail chain owners can find the most competitive rates.

- Review and Adjust Coverage Regularly: As a business grows and changes, its insurance needs may also evolve. Regularly reviewing and adjusting coverage ensures that the business is not over-insured or under-insured, which can lead to unnecessary expenses.

Real-World Examples and Savings

Retail chains across the country have successfully reduced their insurance costs by following these strategies. For instance, a mid-sized clothing retailer managed to save 15% on their annual premiums by bundling their policies and implementing a comprehensive employee training program on safety procedures. Similarly, a national electronics chain reduced their liability insurance costs by installing state-of-the-art surveillance systems, which decreased the likelihood of theft and accidents1.

Exploring Further Options

For retail chain owners looking to delve deeper into insurance savings, numerous resources and specialized services are available. Many websites offer comparison tools that allow businesses to easily see these options and compare coverage from different providers. Additionally, consulting with an insurance broker who specializes in retail chains can provide valuable insights and access to exclusive deals that might not be available directly from insurers.

By leveraging these resources and strategies, retail chain owners can ensure that they are not only protected but also maximizing their savings on insurance costs. This proactive approach not only secures the business's future but also contributes to its overall financial health.