Revealed Top Secret Guide to Must-Have Insurance Choices

Discover the essential insurance choices you need to secure your future, and see these options to ensure you’re fully protected while maximizing your savings.

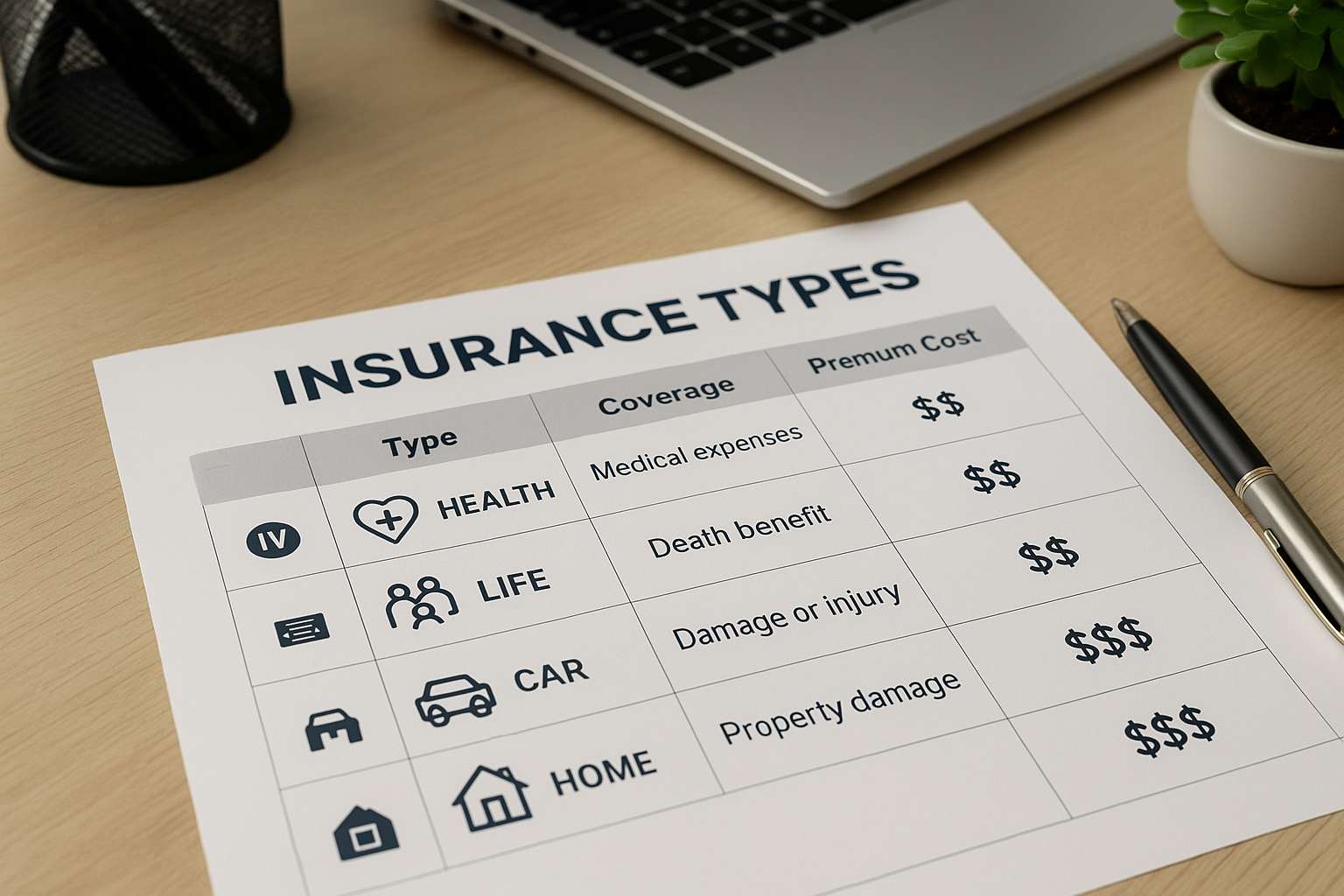

Understanding the Importance of Insurance

Insurance is a crucial component of financial planning, providing a safety net that protects you from unforeseen events. Whether it's health, auto, home, or life insurance, having the right coverage can save you from significant financial loss. By understanding the must-have insurance choices, you can make informed decisions that align with your needs and budget.

Health Insurance: A Non-Negotiable Necessity

Health insurance is arguably the most critical type of coverage you can have. It helps cover medical expenses, from routine check-ups to emergency surgeries. In the U.S., the average cost of a hospital stay can exceed $10,0001, making insurance vital for financial protection. Many employers offer health insurance as part of their benefits package, but if you're self-employed or your employer doesn't provide it, browsing options on the Health Insurance Marketplace can help you find affordable plans.

Auto Insurance: Protecting Your Vehicle and Liability

Auto insurance is mandatory in most states and protects you against financial loss in the event of an accident. The average annual cost of car insurance in the U.S. is about $1,6742. Factors such as your age, driving record, and the type of vehicle you drive can affect your premiums. Consider comparing quotes from different providers to find the best deal. Some insurers offer discounts for bundling policies or maintaining a clean driving record.

Homeowners and Renters Insurance: Safeguarding Your Property

Homeowners insurance covers damage to your home and belongings from events like fires, theft, or natural disasters. The average annual premium for homeowners insurance is approximately $1,3123. Renters insurance, on the other hand, protects your personal property within a rented space and is typically much cheaper, averaging around $179 per year3. Both types offer liability coverage, which is crucial if someone is injured on your property.

Life Insurance: Ensuring Your Loved Ones' Financial Security

Life insurance provides financial support to your beneficiaries in the event of your passing. Policies vary widely, with term life insurance being the most affordable option. It provides coverage for a specific period, typically 10, 20, or 30 years. Whole life insurance, although more expensive, offers lifelong coverage and accumulates a cash value. According to industry data, the average monthly premium for a 20-year term policy with a $500,000 death benefit is around $27 for a healthy 30-year-old male4.

Disability Insurance: Protecting Your Income

Disability insurance is often overlooked but is essential for protecting your income if you become unable to work due to illness or injury. Short-term disability insurance typically covers a portion of your salary for a few months, while long-term disability can provide coverage for several years or until retirement. The cost varies based on factors like age and occupation, but it generally ranges from 1% to 3% of your annual income5.

Exploring Specialized Insurance Options

Beyond the basics, there are specialized insurance options that may be relevant depending on your circumstances. For instance, if you own a business, commercial insurance can protect against potential liabilities and property damage. Pet insurance is another option, helping cover veterinary costs for your furry friends. To explore these options, visit websites dedicated to niche insurance markets for tailored solutions.

Understanding and selecting the right insurance policies is crucial for safeguarding your financial future. By exploring and comparing different options, you can find coverage that meets your needs without breaking the bank. Don't hesitate to follow the options available, ensuring you're fully informed and prepared for whatever life throws your way.