Maximize Your Wealth Fast with Treasury Bill Secrets

Maximize your wealth fast by uncovering the secrets of Treasury Bills, and as you explore these options, you'll discover valuable insights that could transform your financial future.

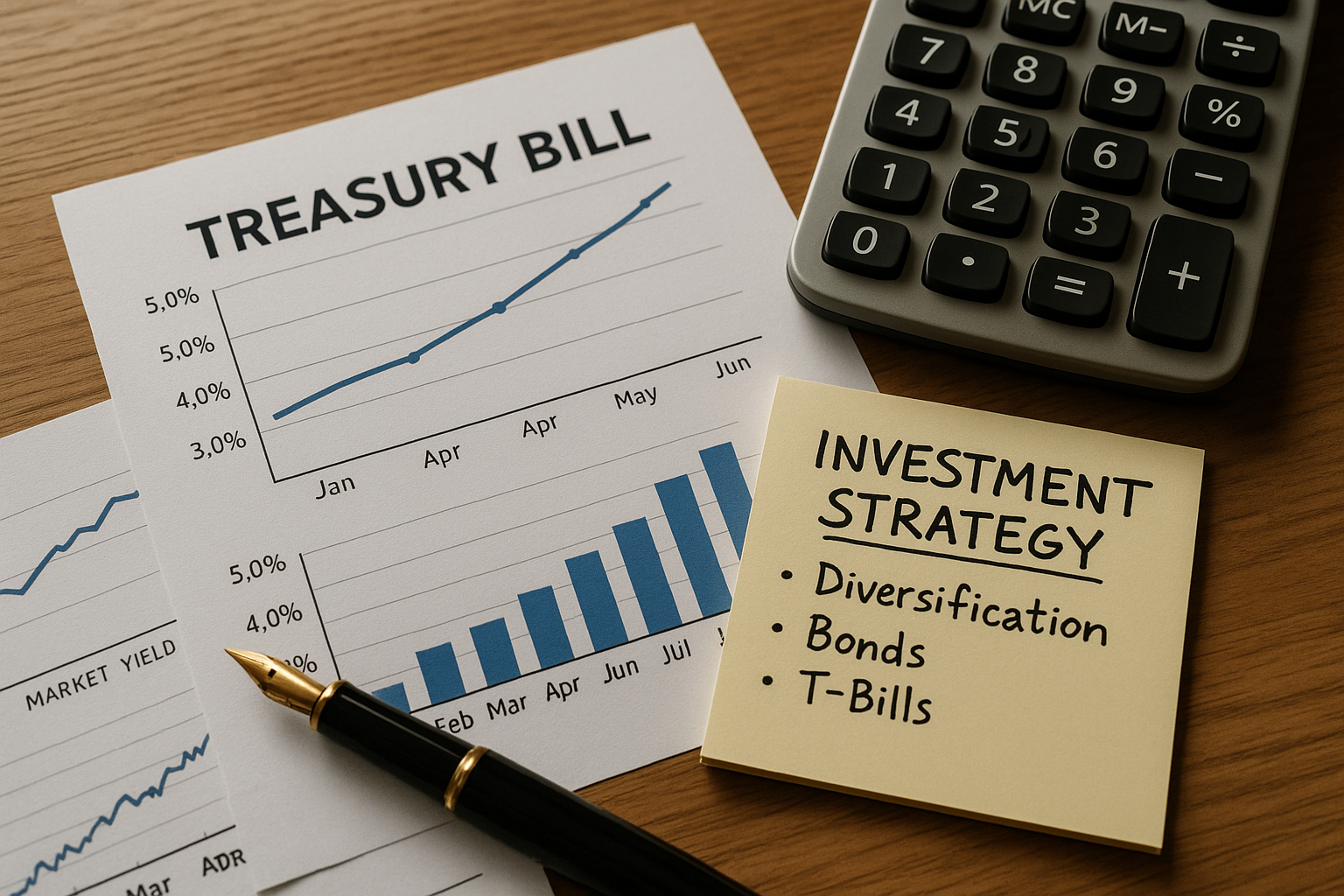

Understanding Treasury Bills: A Safe Investment Avenue

Treasury Bills, or T-Bills, are short-term government securities that offer a secure way to grow your wealth with minimal risk. Unlike stocks or mutual funds, T-Bills are backed by the full faith and credit of the U.S. government, making them one of the safest investment options available. These securities are sold at a discount and mature at face value, meaning you earn the difference as interest. With maturities ranging from a few days to one year, T-Bills provide flexibility and liquidity, allowing you to choose the terms that best suit your financial goals.

How T-Bills Work: A Simple Investment Mechanism

When you purchase a T-Bill, you're essentially lending money to the government. The process is straightforward: you buy the T-Bill at a price lower than its face value, and upon maturity, you receive the full face value. For instance, if you purchase a T-Bill for $9,800 with a face value of $10,000, you earn $200 as interest. The interest income from T-Bills is exempt from state and local taxes, which can enhance your overall returns1.

The Benefits of Investing in T-Bills

Investing in T-Bills offers several advantages:

1. **Safety and Security**: T-Bills are considered one of the safest investments due to their government backing. This makes them an attractive option for risk-averse investors.

2. **Liquidity**: With short maturity periods, T-Bills provide investors with quick access to their money, making them ideal for those who may need to liquidate their investments on short notice.

3. **Tax Advantages**: Interest earned on T-Bills is exempt from state and local taxes, potentially increasing your net earnings2.

4. **Predictable Returns**: Unlike stocks, where returns can be volatile, T-Bills offer a predictable return, allowing for more accurate financial planning.

Maximizing Returns with T-Bills

To maximize your returns with T-Bills, consider the following strategies:

- **Laddering**: This involves purchasing T-Bills with varying maturities, ensuring a steady stream of income and reducing the risk of interest rate fluctuations3.

- **Reinvesting**: Continuously reinvesting the proceeds from matured T-Bills can compound your returns over time, leveraging the power of compound interest.

- **Monitoring Interest Rates**: Keep an eye on interest rate trends, as they affect the discount rate of T-Bills. Purchasing when rates are favorable can enhance your earnings4.

Exploring Additional Resources and Options

For those looking to delve deeper into Treasury Bill investments, numerous resources are available online. Websites like TreasuryDirect provide comprehensive guides and tools to help you navigate the T-Bill market effectively. Additionally, financial advisors can offer personalized strategies tailored to your financial situation, ensuring you make the most of your investment.

Investing in Treasury Bills can be a powerful way to grow your wealth securely and efficiently. By understanding their mechanics and leveraging strategies to maximize returns, you can achieve your financial goals with confidence. As you browse options and explore further resources, you'll find numerous opportunities to enhance your investment portfolio and secure a prosperous financial future.