Maximize Savings with This Bundled Renters Car Deal

Unlock the secret to cutting costs and enhancing convenience by exploring bundled renters and car insurance deals that offer you significant savings and peace of mind—browse options to find the best fit for your needs.

The Advantage of Bundled Renters and Car Insurance

In today's fast-paced world, managing multiple insurance policies can be both time-consuming and costly. By opting for a bundled renters and car insurance deal, you not only simplify your financial obligations but also often enjoy substantial discounts. Insurance companies frequently offer these bundles to encourage customer loyalty, giving you a chance to save anywhere from 5% to 25% on your premiums1.

How Bundling Works

Bundling involves purchasing multiple insurance policies from the same provider. When you choose to bundle your renters and car insurance, the insurer typically offers a discount because it reduces their administrative costs and secures more of your business. This approach not only cuts down on paperwork but also ensures that you have a single point of contact for all your insurance needs, making it easier to manage claims and renewals.

Real-World Savings

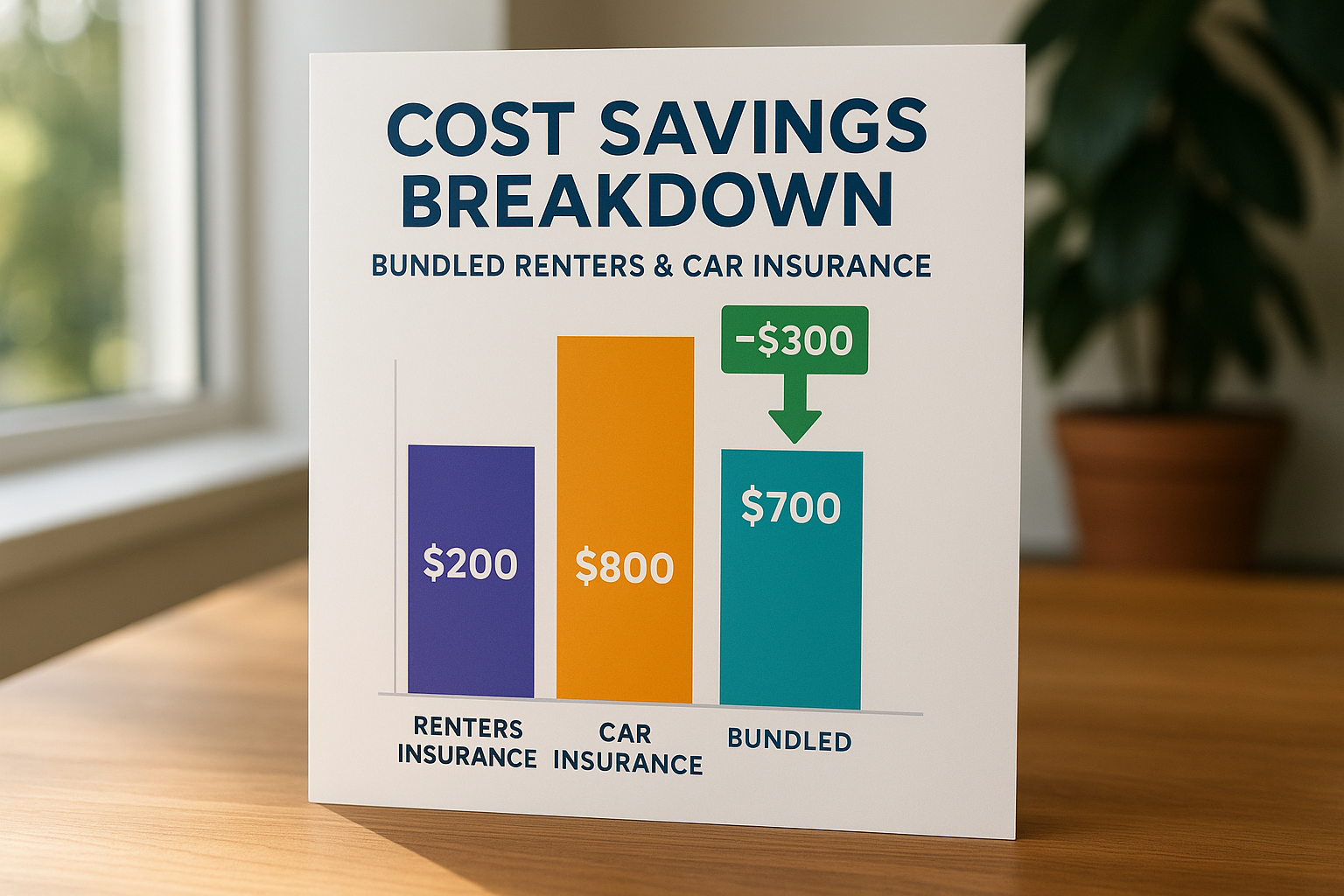

The savings from bundling can be significant. For example, a study by the Insurance Information Institute found that bundling can save policyholders an average of 16% on their premiums2. This can translate to hundreds of dollars in annual savings, depending on the value of your car and the location of your rental property.

Additional Benefits

Beyond financial savings, bundling offers several other advantages. It simplifies the billing process, as you'll receive a single bill for both policies. Moreover, in the event of a claim that involves both your car and rental property, dealing with one insurer can streamline the settlement process. Some insurers also offer added perks, such as priority customer service or enhanced coverage options, to those who bundle their policies3.

Things to Consider

Before committing to a bundled deal, it's important to compare the individual policies and ensure that the bundled offer truly provides the best value. Some insurers may offer competitive standalone policies that, when paired with another company's offerings, could be more cost-effective than a bundle. Additionally, consider the coverage limits and deductibles to ensure they meet your needs.

Finding the Right Deal

To maximize your savings, take the time to search options and compare quotes from multiple insurers. Many companies offer online tools that allow you to customize your coverage and see potential savings instantly. Websites like Insurance.com and NerdWallet provide comparison tools that can help you evaluate different policies and identify the most advantageous bundle for your specific circumstances4.

Wrapping up, bundled renters and car insurance deals offer a practical way to save money while simplifying your insurance management. By assessing your needs and exploring various options, you can find a bundle that not only reduces your expenses but also enhances your coverage. Whether you're looking to cut costs or streamline your insurance portfolio, these deals provide an opportunity to achieve both, ensuring you have the protection you need without the hassle.