Maximize Restaurant Survival With Exclusive Insurance Cost Breakdown

Maximizing your restaurant's survival in a competitive market starts with understanding the exclusive insurance cost breakdown, so browse options to ensure you're getting the best coverage for your needs.

Understanding Restaurant Insurance

Running a restaurant involves numerous risks, from kitchen fires to customer injuries, making insurance not just a necessity but a strategic investment. Restaurant insurance typically covers a range of potential incidents, including property damage, liability claims, and employee injuries. By breaking down the costs associated with these coverages, you can make informed decisions that protect your business while optimizing expenses.

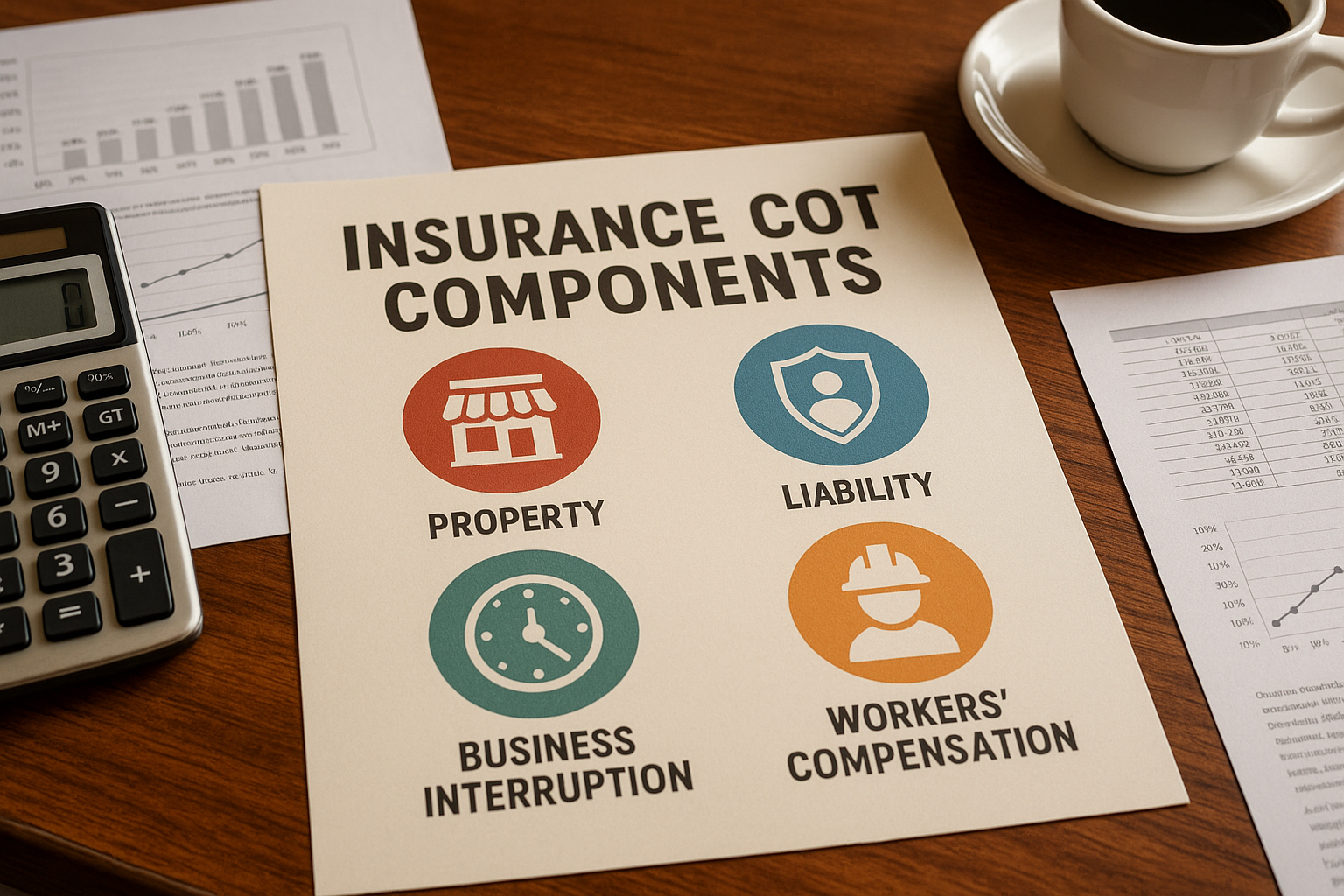

Key Components of Restaurant Insurance

1. **Property Insurance**: This covers damage to your physical assets such as the building, kitchen equipment, and furniture. The cost is influenced by factors like location, building size, and the value of the contents. On average, restaurant property insurance can range from $1,000 to $2,500 annually1.

2. **General Liability Insurance**: Essential for protecting against claims of bodily injury or property damage caused by your business operations. Costs typically range between $500 and $2,000 per year, depending on the size and nature of your restaurant2.

3. **Workers' Compensation Insurance**: Required in most states, this insurance covers medical expenses and lost wages for employees injured on the job. Premiums are calculated based on payroll and industry risk, averaging about $2.70 per $100 of payroll3.

4. **Business Interruption Insurance**: This provides coverage for lost income during periods when your restaurant is closed due to a covered peril, like a fire. The cost is generally a percentage of your property insurance premium, but it can be invaluable in maintaining cash flow during unforeseen closures4.

Strategies to Optimize Insurance Costs

To maximize the value of your insurance, consider bundling policies with the same provider, which can lead to discounts. Regularly reviewing and updating your coverage ensures it aligns with your current business operations and risk profile. Additionally, implementing risk management practices can reduce premiums. For example, installing fire suppression systems or enhancing employee safety training can lower your risk and, consequently, your insurance costs.

Exploring Specialized Insurance Options

For restaurants with unique needs, such as those offering delivery services or serving alcohol, specialized insurance options are available. Liquor liability insurance is crucial for establishments serving alcohol, protecting against claims related to alcohol-induced incidents. Similarly, if your restaurant offers delivery, you might need commercial auto insurance to cover your delivery vehicles.

By understanding and strategically managing your restaurant insurance costs, you can safeguard your business against unforeseen events while optimizing your financial outlay. Explore these options to ensure comprehensive coverage tailored to your specific needs. With the right approach, you can focus on delivering exceptional dining experiences without financial worries.