Maximize Protection with Surprising 3PL Insurance Claims Insight

Unlock the secrets to safeguarding your logistics operations by exploring surprising insights into 3PL insurance claims, and discover how you can minimize risks and maximize protection by taking a moment to browse options and visit websites that offer tailored solutions.

Understanding 3PL Insurance and Its Importance

Third-party logistics (3PL) providers play a crucial role in supply chain management, offering services that range from warehousing to transportation. However, with these services come risks such as cargo damage, theft, and liability issues. Insurance for 3PL providers is not just a protective measure; it's a strategic necessity. By understanding the nuances of 3PL insurance, you can ensure your logistics operations are shielded from unforeseen events, thereby maintaining smooth business operations.

Key Insights into 3PL Insurance Claims

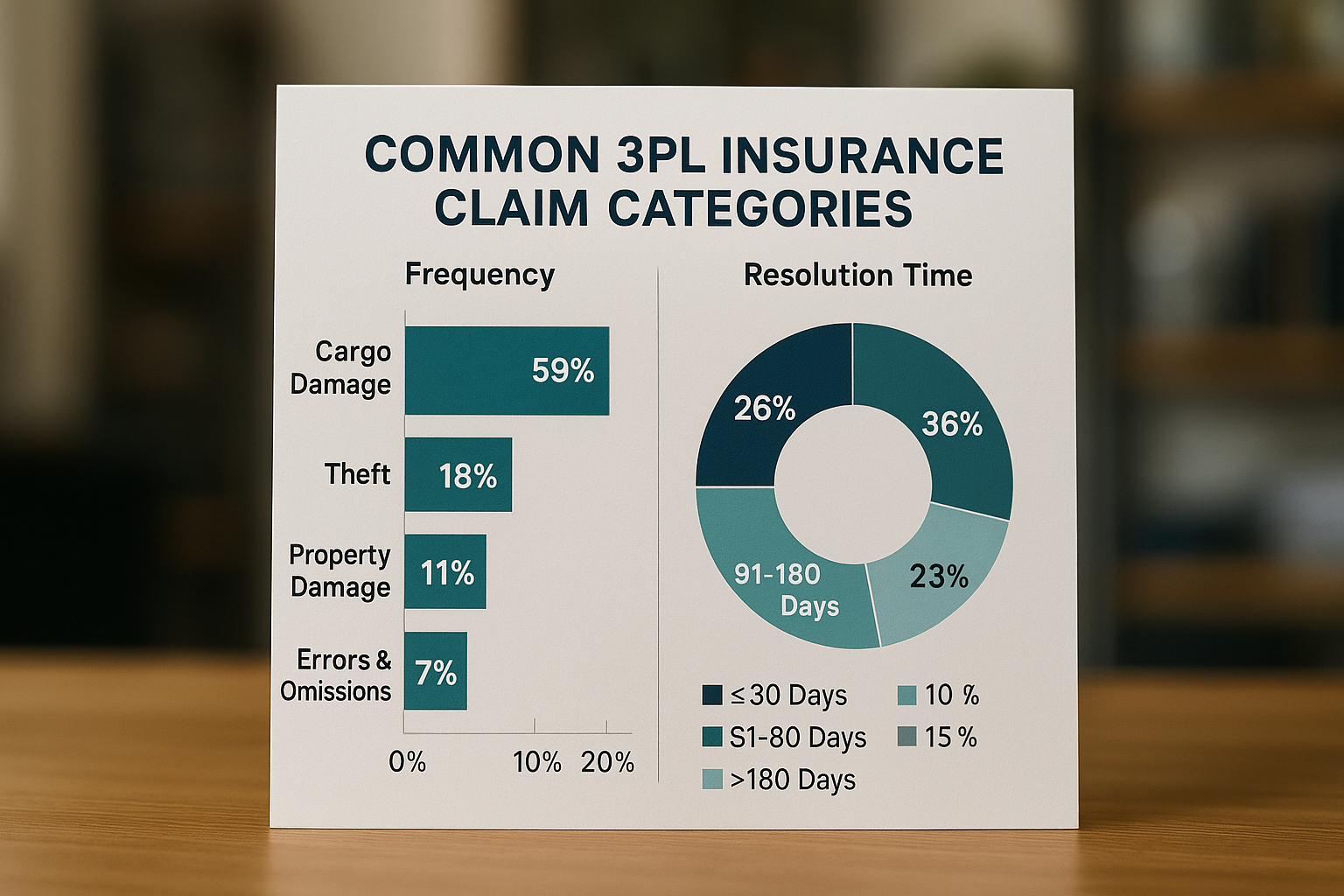

Navigating the landscape of 3PL insurance claims can be daunting. However, gaining insights into common claim scenarios can empower you to make informed decisions. For instance, cargo damage is one of the most frequent claims in the logistics industry. A study revealed that approximately 65% of logistics companies have faced cargo-related claims1. Understanding the causes, such as poor handling or inadequate packaging, can help you implement preventive measures.

Another critical insight is the importance of timely claim filing. Delays in reporting can lead to claim denials, which is why it's vital to have a streamlined process for documenting and reporting incidents. Additionally, partnering with insurance providers that offer dedicated claims support can significantly enhance your ability to manage and resolve claims efficiently.

Types of Coverage Available

3PL insurance is not a one-size-fits-all solution. Various types of coverage are available, each catering to specific needs:

1. **Cargo Insurance**: Protects against loss or damage to goods during transit. This is essential for businesses that frequently ship high-value items.

2. **Liability Insurance**: Covers legal liabilities arising from bodily injury or property damage caused by your operations.

3. **Warehouse Legal Liability**: Provides protection for goods stored in your warehouse, covering damages due to fire, theft, or other perils.

Understanding these options allows you to tailor your insurance plan to your business's unique requirements. Exploring these options can lead you to providers that offer specialized coverage tailored to your operational needs.

Cost Considerations and Financial Benefits

The cost of 3PL insurance can vary based on factors such as the volume of goods handled, the value of the cargo, and the specific risks associated with your operations. On average, logistics companies spend between 0.5% to 1.5% of their annual revenue on insurance2. While this may seem significant, the financial protection and peace of mind it offers are invaluable.

Moreover, investing in comprehensive insurance can lead to cost savings in the long run. By mitigating risks and reducing the likelihood of costly claims, businesses can maintain stable operations and avoid financial disruptions.

Real-World Examples and Case Studies

Consider the case of a mid-sized logistics company that faced a $500,000 cargo damage claim due to inadequate packaging. By having the right insurance coverage, they were able to recover the majority of their losses, highlighting the critical role insurance plays in risk management3.

Another example involves a company that implemented a robust claims management process, reducing their claim resolution time by 30%. This efficiency not only minimized downtime but also improved client satisfaction, demonstrating the operational benefits of effective insurance management4.

In summary, maximizing protection through 3PL insurance requires a strategic approach that includes understanding coverage options, managing claims efficiently, and investing in tailored solutions. As you navigate the complexities of logistics insurance, consider exploring specialized resources and services that align with your business goals, ensuring a robust shield against potential risks.