Maximize profits safely with multiple rental property insurance

Maximize your rental property profits by exploring multiple insurance options that safeguard your investments while offering peace of mind—browse options that can enhance your financial strategy today.

Understanding the Importance of Rental Property Insurance

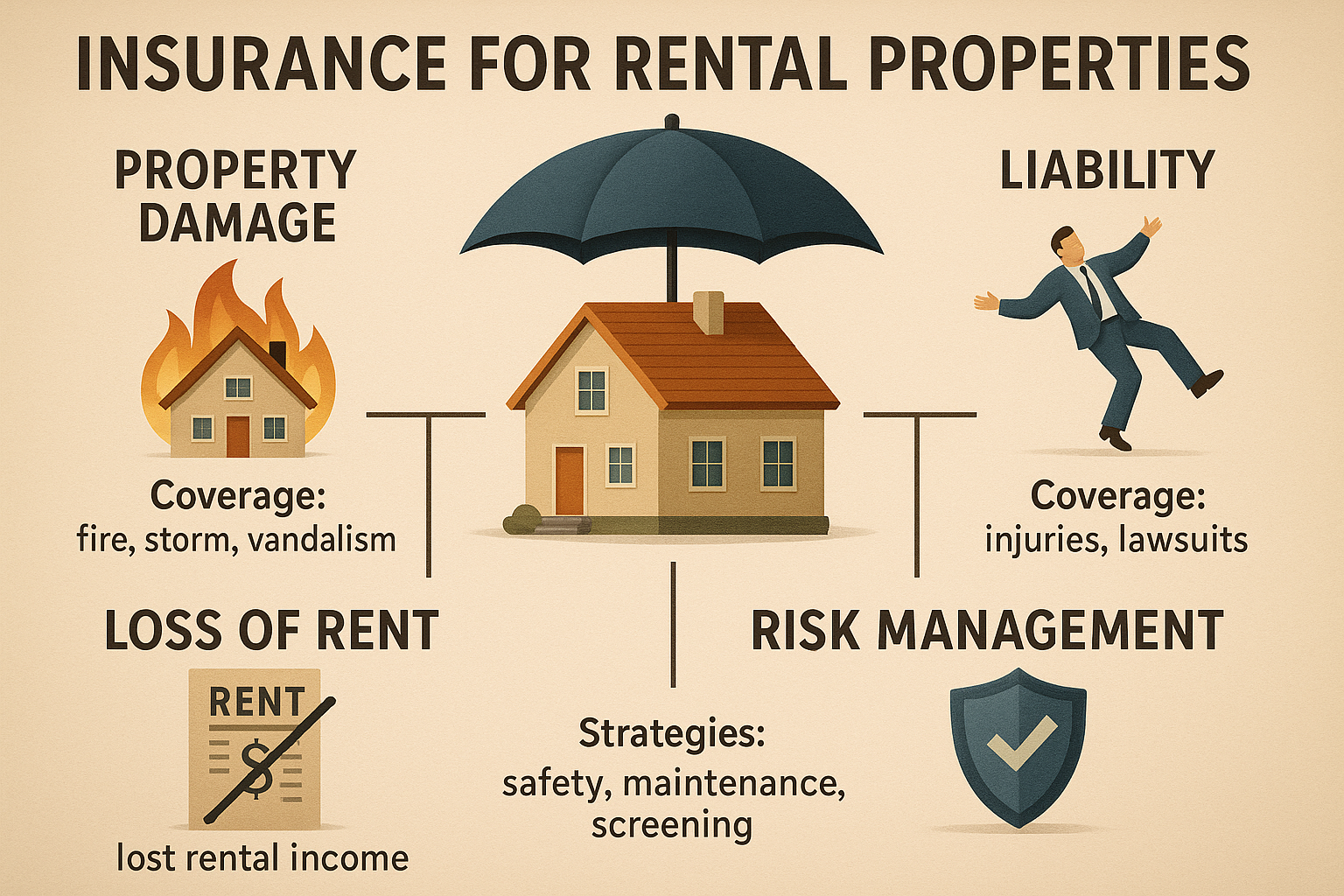

Owning rental properties can be a lucrative venture, but it also comes with its share of risks. From property damage to liability claims, the potential for financial loss is significant. This is where rental property insurance plays a critical role. Unlike standard homeowner's insurance, rental property insurance is designed to protect landlords from the unique risks associated with rental properties. It typically covers the building itself, liability protection, and loss of rental income if the property becomes uninhabitable due to a covered loss.

Types of Rental Property Insurance

When it comes to insuring your rental properties, there are several types of policies to consider:

1. Landlord Insurance

Landlord insurance is a comprehensive policy that covers the physical structure of the rental property, liability protection, and loss of rental income. This type of insurance is essential for landlords who want to protect their investment from damages caused by tenants or natural disasters.

2. Liability Insurance

Liability insurance protects you from legal claims if someone is injured on your property. This is particularly important for landlords, as they can be held liable for accidents or injuries that occur on their premises.

3. Loss of Income Insurance

This insurance compensates landlords for lost rental income if the property becomes uninhabitable due to a covered event, such as a fire or severe storm. It ensures that you continue to receive income even when your property is temporarily out of commission.

Financial Benefits of Multiple Insurance Policies

Investing in multiple insurance policies might seem like an added expense, but it can actually lead to significant savings and increased profits in the long run. By having comprehensive coverage, you minimize the risk of out-of-pocket expenses for repairs, legal fees, or lost income. Additionally, many insurance providers offer discounts for bundling multiple policies, which can further reduce your costs.

Real-World Examples and Statistics

According to the Insurance Information Institute, about 37% of U.S. households are occupied by renters1. This statistic underscores the importance of having adequate insurance coverage to protect rental properties. Moreover, a study by the National Multifamily Housing Council reveals that the demand for rental properties is on the rise, highlighting the need for landlords to safeguard their investments2.

Exploring Specialized Insurance Options

For landlords with unique properties or specific needs, specialized insurance options are available. For instance, properties located in flood-prone areas may require additional flood insurance, as standard policies typically do not cover flood damage. Similarly, landlords renting to short-term tenants through platforms like Airbnb may need a different type of coverage to address the specific risks associated with short-term rentals.

Key Takeaways

Maximizing profits from your rental properties requires more than just collecting rent; it involves strategic planning and risk management. By investing in multiple rental property insurance options, you can protect your assets, ensure steady income, and ultimately enhance your financial stability. As you explore these options, consider visiting websites and searching for policies that best fit your needs to ensure comprehensive coverage and peace of mind.