Insider Guide Save Big on Renters Insurance Mississippi

Unlock significant savings on your renters insurance in Mississippi by exploring options that can lower your premiums while ensuring comprehensive coverage.

Understanding Renters Insurance in Mississippi

Renters insurance is a crucial safeguard for anyone leasing a home or apartment in Mississippi. With the unpredictable nature of weather in the region, from hurricanes to tornadoes, having a robust renters insurance policy is essential. This type of insurance typically covers personal property, liability, and additional living expenses in case of a disaster. By understanding the different components and options available, you can effectively protect your assets without breaking the bank.

Why Renters Insurance is Essential

Many renters underestimate the value of insurance, assuming that their landlord's policy will cover any damages. However, a landlord's insurance typically only covers the building structure, leaving personal belongings vulnerable. Renters insurance offers protection for your possessions against theft, fire, and other perils. Additionally, it provides liability coverage, which can be invaluable if someone is injured in your home or if you accidentally damage someone else's property.

Factors Influencing Renters Insurance Costs

Several factors can influence the cost of renters insurance in Mississippi, including:

- Location: Areas prone to natural disasters or high crime rates may have higher premiums.

- Coverage Amount: The value of your personal property and the level of liability coverage you choose will impact costs.

- Deductible: A higher deductible can lower your premium, but it means you'll pay more out-of-pocket in the event of a claim.

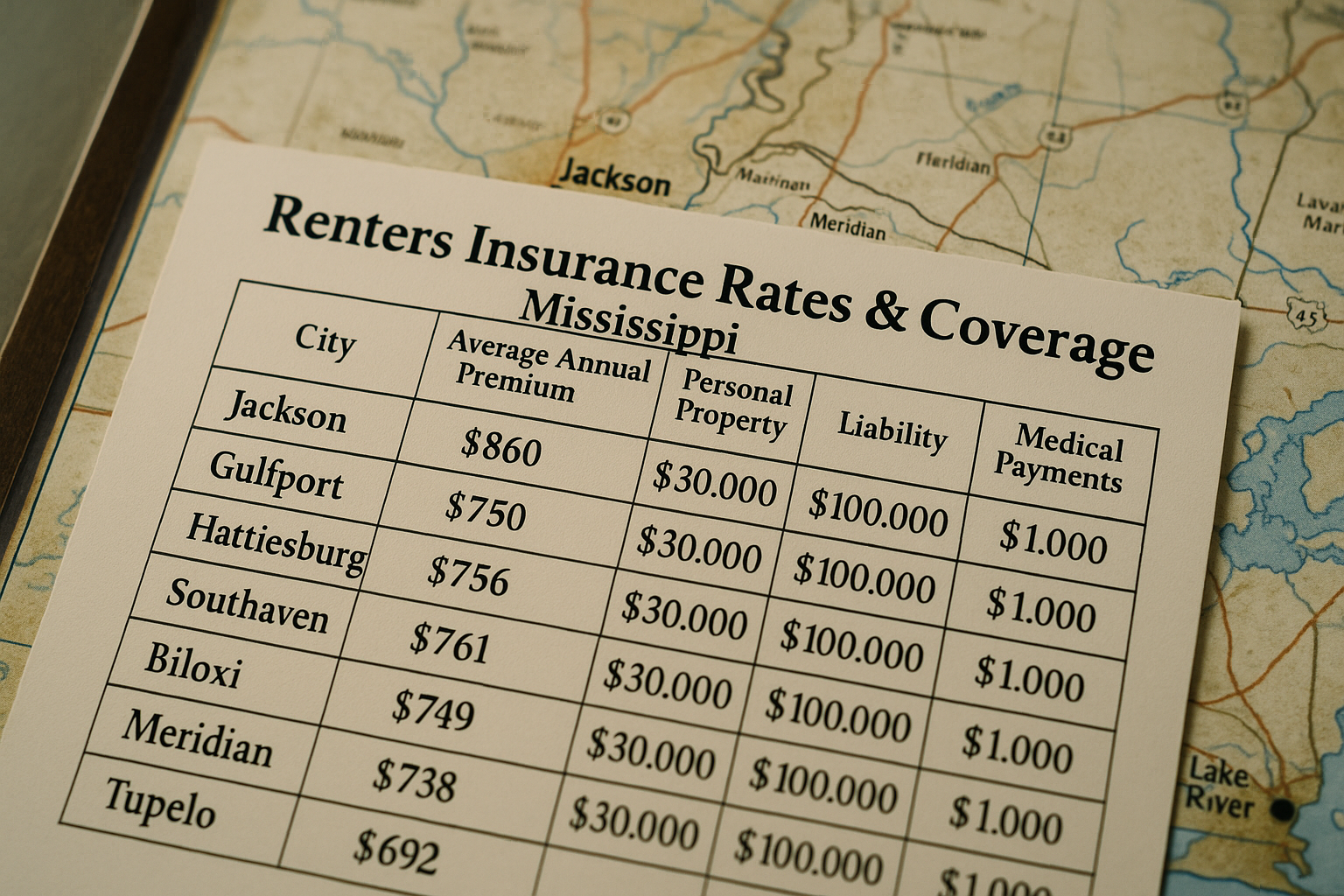

According to recent data, the average cost of renters insurance in Mississippi is about $250 per year, which is slightly above the national average1. However, there are numerous ways to reduce these costs.

Tips to Save on Renters Insurance

1. **Bundle Policies**: Many insurance companies offer discounts if you bundle your renters insurance with other policies, such as auto insurance. This can lead to significant savings.

2. **Increase Your Deductible**: Opting for a higher deductible can decrease your premium. Just ensure that you have enough savings to cover the deductible if needed.

3. **Install Safety Features**: Adding smoke detectors, burglar alarms, and other safety features can lower your insurance costs by reducing the risk of claims.

4. **Compare Quotes**: Shopping around and comparing quotes from different insurers is one of the most effective ways to find a competitive rate. You can browse options online to find the best deal.

5. **Maintain a Good Credit Score**: Insurers often use credit scores to determine premiums. A higher credit score can result in lower insurance costs.

Exploring Specialized Options

For those with unique needs, such as high-value items or specific liability concerns, specialized renters insurance policies may be available. These policies can offer additional coverage for items like jewelry, electronics, or business equipment kept at home. It's worth visiting websites of major insurance providers to see these options and find a policy tailored to your specific requirements.

By understanding the intricacies of renters insurance and taking proactive steps, you can secure a policy that offers comprehensive protection at an affordable price. Whether you're bundling policies, enhancing home security, or comparing quotes, these strategies enable you to save significantly on your renters insurance in Mississippi. For those ready to take action, exploring the available options can lead to immediate benefits and peace of mind.