Get Smart Protection Cyber Insurance Secrets Revealed

As cyber threats continue to evolve, you can stay one step ahead by exploring the latest options in cyber insurance to protect your business and personal data; see these options to secure peace of mind and financial safety.

Understanding Cyber Insurance: Why It Matters

In today's digital age, cyber insurance has become a critical component for both businesses and individuals looking to safeguard their digital assets. As cybercrime costs are projected to reach $10.5 trillion annually by 20251, the need for robust protection against data breaches, ransomware, and other cyber threats is more pressing than ever. Cyber insurance provides a safety net, covering financial losses and offering resources for recovery after an attack.

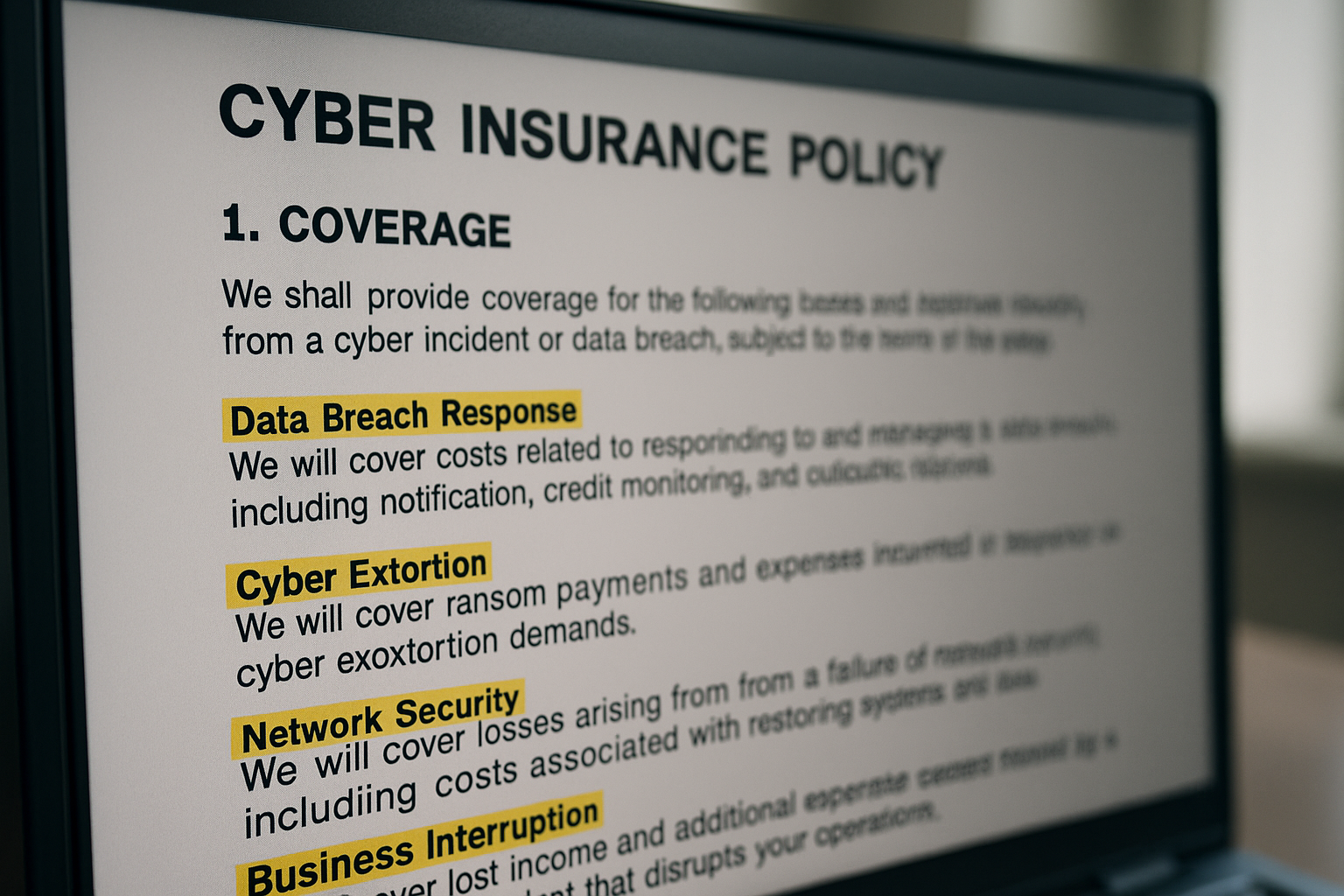

Types of Cyber Insurance Coverage

Cyber insurance policies can vary significantly, but they generally fall into two main categories: first-party and third-party coverage. First-party coverage protects your business from direct losses such as data breaches, network damage, and business interruption. In contrast, third-party coverage shields you from claims made by clients or partners affected by a cyber incident on your network. By understanding these distinctions, you can tailor your policy to meet specific needs and mitigate potential risks effectively.

Evaluating the Cost of Cyber Insurance

The cost of cyber insurance can vary widely, influenced by factors such as the size of your business, the industry you operate in, and your current cybersecurity measures. On average, small businesses might pay between $1,000 and $7,500 annually for a policy2. However, investing in cybersecurity measures like firewalls and employee training can often lead to reduced premiums. It's crucial to compare policies and browse options to find the best coverage at the most competitive price.

Key Benefits of Cyber Insurance

Investing in cyber insurance offers a multitude of benefits beyond financial protection. One of the most significant advantages is access to a network of experts who can assist in managing the aftermath of a cyber incident. This includes forensic investigators, legal teams, and public relations specialists who can help mitigate damage to your reputation and restore operations swiftly. Additionally, many insurers offer risk management resources to help prevent breaches before they occur, providing a proactive approach to cybersecurity.

Exploring Specialized Cyber Insurance Options

For businesses with unique needs, specialized cyber insurance options are available. These can include coverage for social engineering attacks, which have become increasingly common, or policies that address the specific risks associated with remote work environments. As cyber threats continue to diversify, having a tailored policy ensures comprehensive protection. Visit websites of leading insurers to explore these specialized services and find a policy that aligns with your specific requirements.

Final Thoughts

In a world where cyber threats are ever-present, cyber insurance is not just a luxury but a necessity. By understanding the different types of coverage, evaluating costs, and recognizing the benefits, you can make informed decisions to protect your digital assets. As you navigate the landscape of cyber insurance, remember to explore the various options available to ensure you have the right protection in place. With the right policy, you can operate with confidence, knowing you're prepared for whatever cyber threats may arise.