Get Lower Payments Auto Loan Refinance Quote Secrets

Unlocking the secrets to lower your auto loan payments can transform your financial landscape, and by browsing options or visiting websites, you can discover the best refinancing opportunities tailored to your needs.

Understanding Auto Loan Refinancing

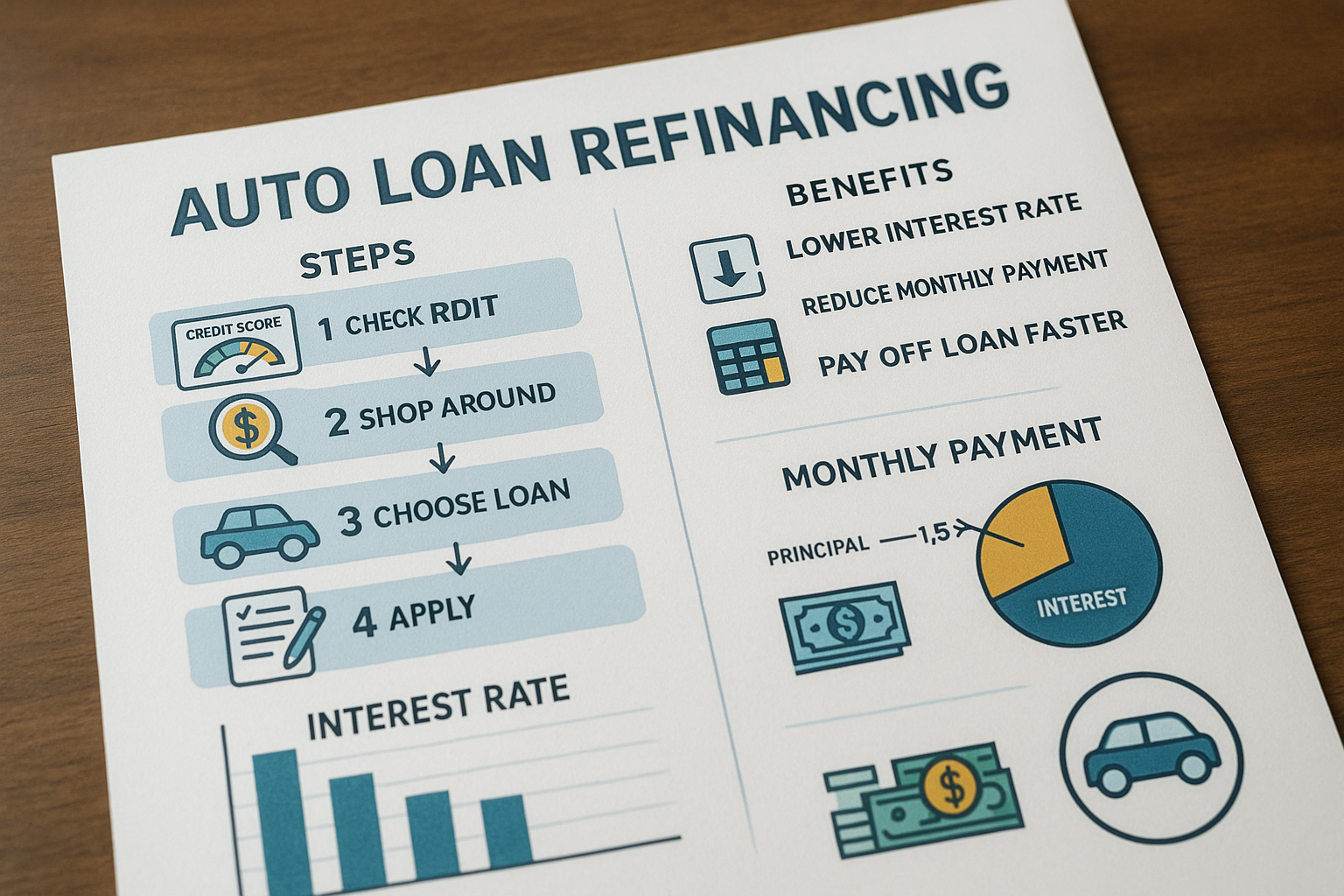

Auto loan refinancing involves replacing your current car loan with a new one, typically from a different lender, to secure better terms and lower monthly payments. This can be a strategic move if interest rates have dropped since you first financed your vehicle, or if your credit score has improved, allowing you to qualify for more favorable terms. The primary goal is to reduce your financial burden by decreasing your monthly payments, which can free up cash for other expenses or savings.

Benefits of Refinancing Your Auto Loan

Refinancing your auto loan offers several compelling benefits. Firstly, it can significantly lower your monthly payments by securing a lower interest rate. For instance, if you initially financed at a high rate due to a lower credit score, refinancing can help you take advantage of improved credit conditions1. Additionally, extending the term of your loan can further reduce monthly payments, though this may increase the total interest paid over the life of the loan.

Another advantage is the potential to switch to a lender who offers better customer service or more flexible payment options. This can make managing your loan easier and less stressful. Moreover, refinancing can help you remove a co-signer from your loan, which is beneficial if your financial situation has improved and you wish to take full responsibility for the loan.

How to Get the Best Refinance Quote

To secure the best auto loan refinance quote, start by checking your credit score. A higher score can qualify you for lower interest rates, so it may be worth taking steps to improve your credit before applying2. Next, gather information about your current loan, including the balance, interest rate, and remaining term. This will help you compare offers effectively.

Research multiple lenders to compare rates and terms. Online platforms can be particularly helpful, allowing you to browse options and see these options side-by-side. Be sure to consider both traditional banks and credit unions, as they may offer competitive rates and terms. It's also wise to check for any fees associated with refinancing, such as application or origination fees, which can impact the overall savings.

Real-World Examples and Savings

Consider a scenario where you have a $20,000 auto loan at a 6% interest rate with three years remaining. By refinancing at a 4% interest rate, you could save approximately $600 over the life of the loan3. These savings can be even more substantial if your initial loan was at a higher rate or if you choose to extend the loan term.

Considerations Before Refinancing

While refinancing can offer significant savings, it's important to consider the potential downsides. Extending the loan term can result in paying more interest overall, even if your monthly payments are lower4. Additionally, if your car is older or has high mileage, some lenders may be hesitant to offer refinancing.

Ensure that any fees associated with refinancing do not outweigh the benefits. Calculate the total cost of the new loan compared to your current loan to determine if refinancing makes financial sense.

Ultimately, refinancing your auto loan can be a powerful tool for reducing your financial burden. By exploring the right options and understanding the potential savings, you can make an informed decision that aligns with your financial goals. For those interested in specific solutions, there are numerous resources and specialized services available to guide you through the refinancing process.