Florida Hurricane Zone Insurance Secrets Finally Revealed

If you're living in Florida's hurricane zone, understanding the intricacies of insurance can save you thousands and give you peace of mind—browse options now to secure your home and future.

Understanding the Florida Hurricane Insurance Landscape

Florida's unique geographical location makes it a prime target for hurricanes, which directly impacts the insurance market. Homeowners in this region face higher premiums due to the increased risk of damage from severe weather. According to the Insurance Information Institute, Florida has the highest average home insurance premium in the United States, largely due to its vulnerability to hurricanes1.

Types of Insurance Coverage Available

Homeowners in Florida typically require a combination of insurance policies to fully protect their properties. Standard home insurance policies often do not cover hurricane-related flooding, necessitating additional coverage:

- Windstorm Insurance: This covers damage caused by wind and hail, essential for hurricane-prone areas. Some insurers may require a separate windstorm policy.

- Flood Insurance: Offered through the National Flood Insurance Program (NFIP), this policy covers flood damage, which is not included in standard home insurance.

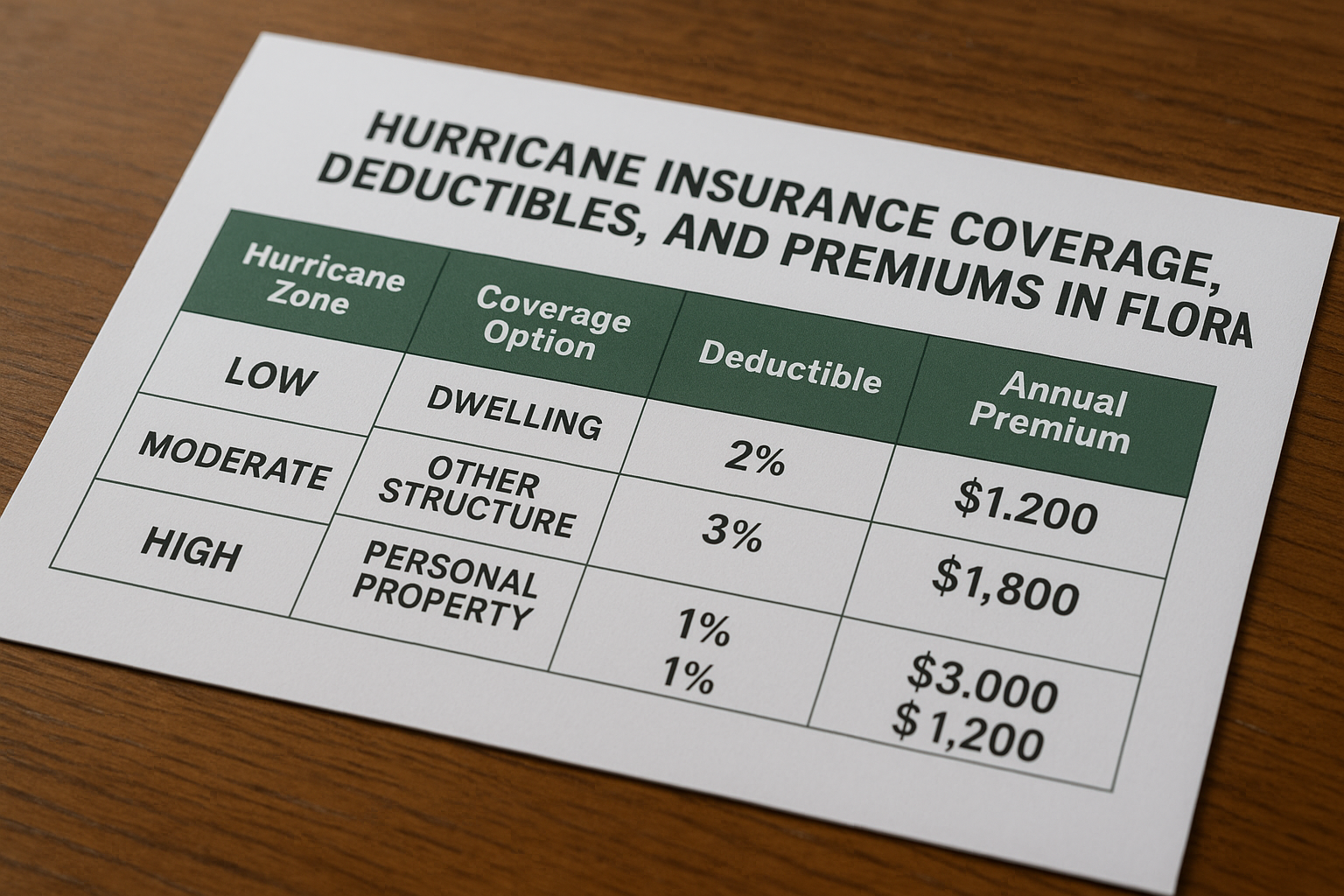

- Hurricane Deductibles: Unlike regular deductibles, hurricane deductibles are calculated as a percentage of the home's insured value, often ranging from 1% to 5%2.

Cost-Saving Strategies

While insurance in Florida's hurricane zone can be costly, there are strategies to mitigate expenses:

The Role of State Programs

Florida has implemented several programs to assist homeowners in managing their insurance costs and coverage:

Exploring Additional Resources

For those seeking more tailored solutions, numerous online resources and professional services can provide further guidance. Homeowners are encouraged to visit websites that specialize in hurricane insurance to learn more about specific coverage options and how to optimize their policies.

Navigating the complexities of hurricane insurance in Florida requires diligence and informed decision-making. By understanding your coverage needs, exploring cost-saving strategies, and leveraging state programs, you can better protect your home and finances. Follow the options available to ensure you are fully prepared for the next hurricane season.