Find Top Vision Insurance Plan Comparison for Savings

Discover how comparing top vision insurance plans can lead to significant savings and better eye care coverage, prompting you to browse options and find the best fit for your needs.

Understanding Vision Insurance

Vision insurance is a specialized type of coverage designed to help reduce the cost of eye care services and products. Unlike standard health insurance, vision plans typically focus on routine eye exams, prescription glasses, and contact lenses. With the rising costs of healthcare, having a vision insurance plan can be a strategic way to manage your expenses while ensuring you receive the necessary eye care.

Key Benefits of Comparing Vision Insurance Plans

When you take the time to compare vision insurance plans, you open the door to several benefits. Firstly, you can find plans that offer comprehensive coverage at competitive rates, ensuring you get the best value for your money. Additionally, by exploring different options, you may uncover plans that provide discounts on eyewear and even corrective surgeries like LASIK.

Furthermore, many vision insurance providers offer tiered plans, allowing you to choose the level of coverage that best suits your needs and budget. By browsing these options, you can tailor your plan to include only the services you require, potentially lowering your premiums.

Types of Vision Insurance Plans

Vision insurance plans generally fall into two categories: standalone vision plans and vision benefits offered as part of a broader health insurance package. Standalone plans are ideal for individuals who want dedicated eye care coverage without altering their existing health insurance. These plans often include annual eye exams, discounts on eyewear, and allowances for contact lenses.

On the other hand, vision benefits that come with health insurance plans might offer more limited coverage but are typically included at a lower cost. It's crucial to evaluate the extent of coverage and compare it with standalone options to determine which is more beneficial for you.

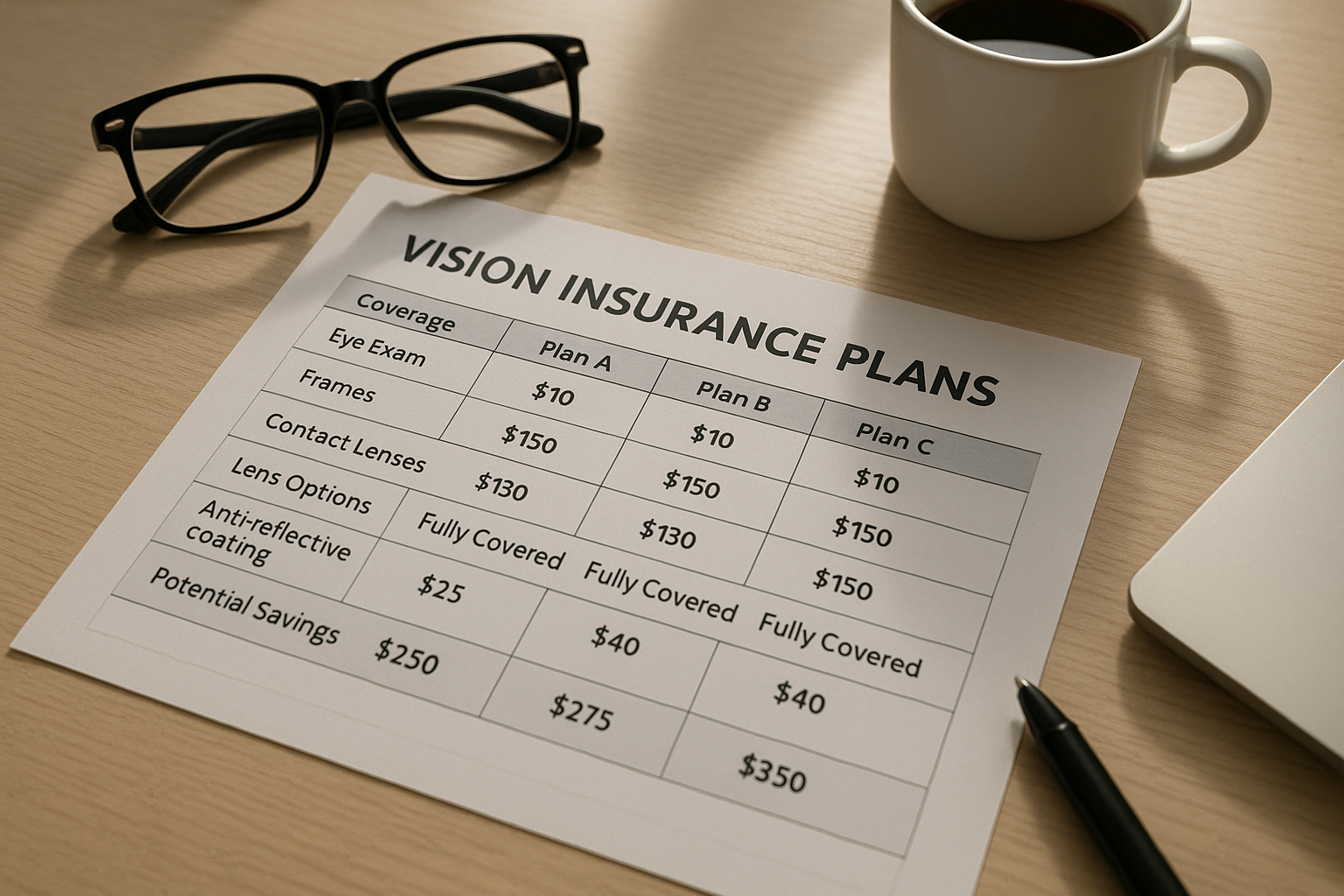

Real-World Pricing and Savings

The cost of vision insurance can vary widely depending on the provider and the level of coverage. On average, standalone vision plans can range from $10 to $30 per month1. However, by comparing different plans, you might find promotional offers or discounts that can reduce your premiums.

For instance, some insurers offer family plans, which can be more cost-effective if you need coverage for multiple people. Additionally, employers often provide group vision insurance at discounted rates, making it worthwhile to explore these options if available.

How to Compare Vision Insurance Plans

To effectively compare vision insurance plans, start by assessing your specific needs. Consider how often you visit the eye doctor, whether you wear glasses or contacts, and if you anticipate needing any specialized eye care services. Next, visit websites of various insurance providers and use their comparison tools to analyze coverage details, costs, and network providers.

Pay attention to the fine print, such as annual allowances for eyewear, co-pays for exams, and any exclusions or limitations. By thoroughly reviewing these aspects, you can make an informed decision that maximizes your benefits and minimizes your out-of-pocket expenses.

Finally, don't hesitate to reach out to insurance representatives for clarification on any plan details. They can provide insights into potential savings and help you navigate the options available.

By taking the time to compare vision insurance plans, you empower yourself to make a choice that not only fits your budget but also ensures you receive quality eye care. As you explore these options, remember that the right plan can lead to significant savings and peace of mind.