Find the Lowest Motorcycle Loan Financing Rates Today

Finding the lowest motorcycle loan financing rates today can save you thousands, so take a moment to browse options and discover the best deals that fit your budget and lifestyle.

Understanding Motorcycle Loan Financing

Motorcycle loan financing is a practical solution for those looking to purchase a motorcycle without having to pay the full price upfront. These loans are specifically designed to cater to the needs of motorcycle buyers, offering tailored interest rates and repayment terms. By understanding how these loans work, you can make informed decisions that could lead to significant financial savings.

Factors Affecting Motorcycle Loan Rates

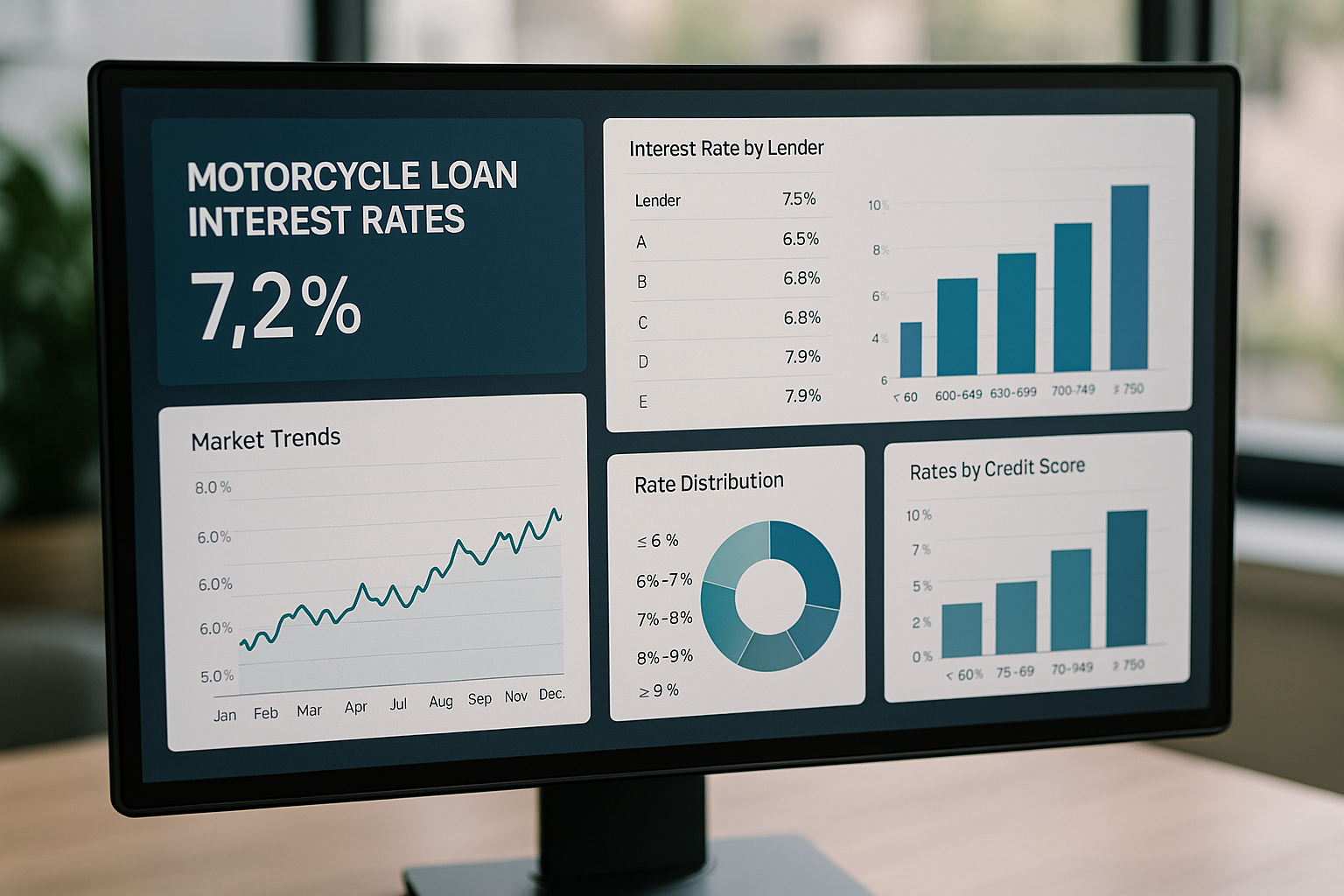

Interest rates on motorcycle loans can vary based on several factors:

1. **Credit Score**: Your credit score is one of the most significant determinants of the interest rate you'll receive. A higher credit score typically results in a lower interest rate, as it reflects your reliability as a borrower1.

2. **Loan Term**: The length of the loan can also impact the interest rate. Generally, shorter loan terms come with lower rates, but they require higher monthly payments2.

3. **Down Payment**: Making a larger down payment can reduce the loan amount and potentially secure a lower interest rate.

4. **Lender Type**: Rates may differ between banks, credit unions, and online lenders. Credit unions often offer competitive rates due to their non-profit status3.

Exploring Your Loan Options

To find the best financing rates, it's crucial to compare offers from multiple lenders. Here’s how you can efficiently search options:

- **Online Lenders**: These platforms often provide quick comparisons and pre-qualification processes that don’t affect your credit score. They can offer competitive rates and flexible terms.

- **Credit Unions**: As member-owned institutions, credit unions may offer lower rates and personalized service. Check if you're eligible to join one in your area.

- **Dealership Financing**: Some motorcycle dealerships offer in-house financing options. While convenient, it's important to compare these rates with external lenders to ensure you're getting the best deal.

Current Trends and Opportunities

The motorcycle financing market is currently seeing favorable trends for borrowers. Interest rates have been relatively low, making it an opportune time to secure financing. Additionally, many lenders are offering promotions such as zero down payment options or deferred payments for the first few months4.

Steps to Secure the Best Rate

To ensure you get the lowest motorcycle loan rates, follow these steps:

1. **Check Your Credit**: Before applying, review your credit report to correct any inaccuracies and improve your score if possible.

2. **Calculate Your Budget**: Determine how much you can afford to pay monthly, considering potential insurance and maintenance costs.

3. **Get Pre-Approved**: Pre-approval can give you a clear idea of the loan amount and interest rate you qualify for, strengthening your negotiating position at the dealership.

4. **Negotiate**: Don’t hesitate to negotiate terms with lenders or dealers. Having multiple offers can give you leverage to secure better rates.

Final Thoughts

Securing the lowest motorcycle loan financing rates requires a strategic approach that includes understanding your financial standing, exploring various lender options, and seizing current market opportunities. As you embark on this journey, remember that the right loan can significantly enhance your purchasing power and financial health. For those ready to dive deeper, numerous resources and specialized services are available to guide you through this process.