Choose Your Ideal Precious Metals IRA Custodian Effortlessly

Choosing the right precious metals IRA custodian is crucial to safeguarding your retirement savings, and by taking a moment to browse options and visit websites, you can unlock valuable insights that simplify this important decision.

Understanding Precious Metals IRAs

A precious metals IRA is a type of self-directed individual retirement account that allows you to invest in physical gold, silver, platinum, and palladium. These accounts offer a hedge against inflation and economic uncertainty, providing a sense of security for your financial future. Unlike traditional IRAs that focus on stocks and bonds, precious metals IRAs are backed by tangible assets, which can be particularly appealing in volatile markets.

Why the Right Custodian Matters

Choosing the right custodian for your precious metals IRA is essential because custodians are responsible for the safekeeping of your investments. They handle various administrative tasks, including the purchase, transport, and storage of metals, as well as ensuring compliance with IRS regulations. A reputable custodian can offer peace of mind, knowing that your assets are managed securely and efficiently.

Factors to Consider When Choosing a Custodian

When evaluating potential custodians, consider the following factors:

1. **Reputation and Experience**: Look for custodians with a solid track record and positive reviews. Established firms with years of experience in the precious metals industry are often more reliable.

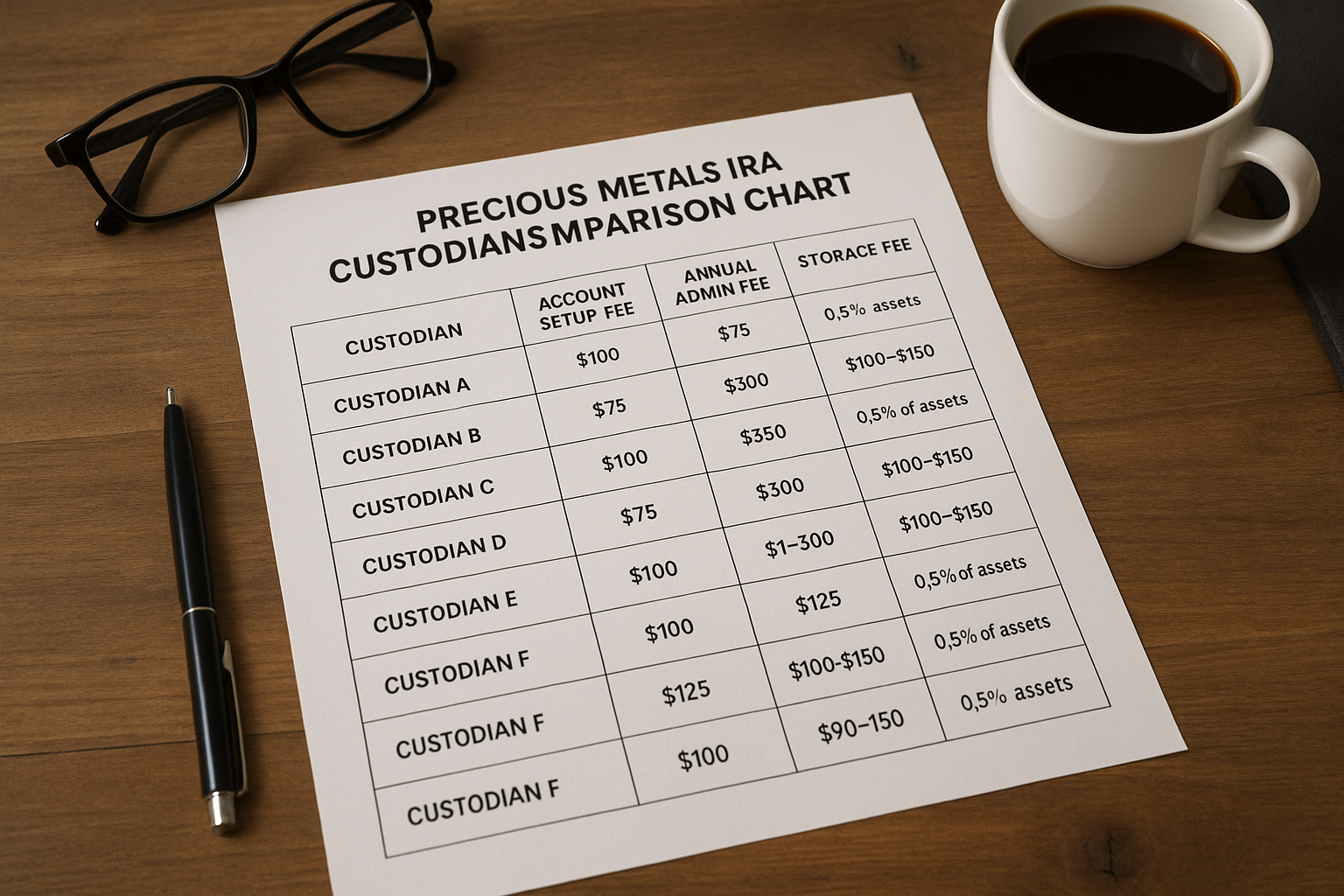

2. **Fees and Costs**: Custodians charge various fees, including setup fees, storage fees, and annual maintenance fees. It's crucial to understand these costs upfront and compare them across different custodians to ensure you're getting a fair deal.

3. **Storage Options**: Ensure the custodian offers secure storage facilities that are either segregated or non-segregated. Segregated storage keeps your metals separate from others, providing an extra layer of security.

4. **Customer Service**: A custodian with excellent customer service can make a significant difference. They should be accessible, responsive, and willing to address any questions or concerns you may have.

5. **Compliance and Insurance**: Verify that the custodian complies with IRS regulations and offers adequate insurance coverage to protect your investments from potential risks.

Exploring Custodian Options

To find the best custodian for your needs, start by browsing options and visiting websites of reputable firms. Many custodians offer free consultations to discuss your investment goals and provide detailed information about their services. This is an excellent opportunity to ask questions and assess their level of expertise and customer support.

Real-World Examples

Consider companies like GoldStar Trust, a well-known custodian with years of experience in the precious metals industry, offering competitive fees and secure storage options1. Another option is Equity Trust, which provides a wide range of investment options and exceptional customer service2. These examples highlight the diversity and quality of services available, making it easier for you to find a custodian that aligns with your investment strategy.

Making Your Decision

Once you've gathered information and compared custodians, take time to weigh the pros and cons of each option. Consider your long-term investment goals and how each custodian can help you achieve them. Remember, the right custodian will not only safeguard your assets but also provide valuable insights and support throughout your investment journey.

By understanding the importance of selecting the right custodian and exploring the available options, you can confidently make an informed decision that secures your financial future. Whether you're new to precious metals investing or looking to optimize your existing IRA, the resources and insights gained from this process will serve as a valuable foundation.