Adult Dental Insurance Plans Revealed Save Thousands Instantly

Imagine saving thousands on your dental care by simply taking a moment to browse options for adult dental insurance plans that can transform your financial health and oral well-being.

Understanding Adult Dental Insurance Plans

Dental insurance is often overlooked by adults, yet it plays a crucial role in maintaining both oral and financial health. Unlike general health insurance, dental plans are specifically designed to cover the costs associated with preventive care, treatments, and even major procedures. For many, the challenge lies in navigating the plethora of available options and understanding the benefits each plan offers. By taking the time to search options and compare plans, you can find coverage that not only meets your needs but also saves you money.

Types of Dental Insurance Plans

There are several types of dental insurance plans to consider, each with its unique structure and benefits:

- Preferred Provider Organization (PPO): This plan offers a network of dentists who agree to provide services at reduced rates. While you can see any dentist, staying within the network often results in lower out-of-pocket costs.

- Health Maintenance Organization (HMO): An HMO plan requires you to choose a primary dentist and get referrals for specialists. It typically costs less than a PPO but offers less flexibility.

- Indemnity Plans: These plans offer the most flexibility, allowing you to visit any dentist. They reimburse a portion of your dental expenses, but you may have higher out-of-pocket costs.

Financial Benefits and Savings

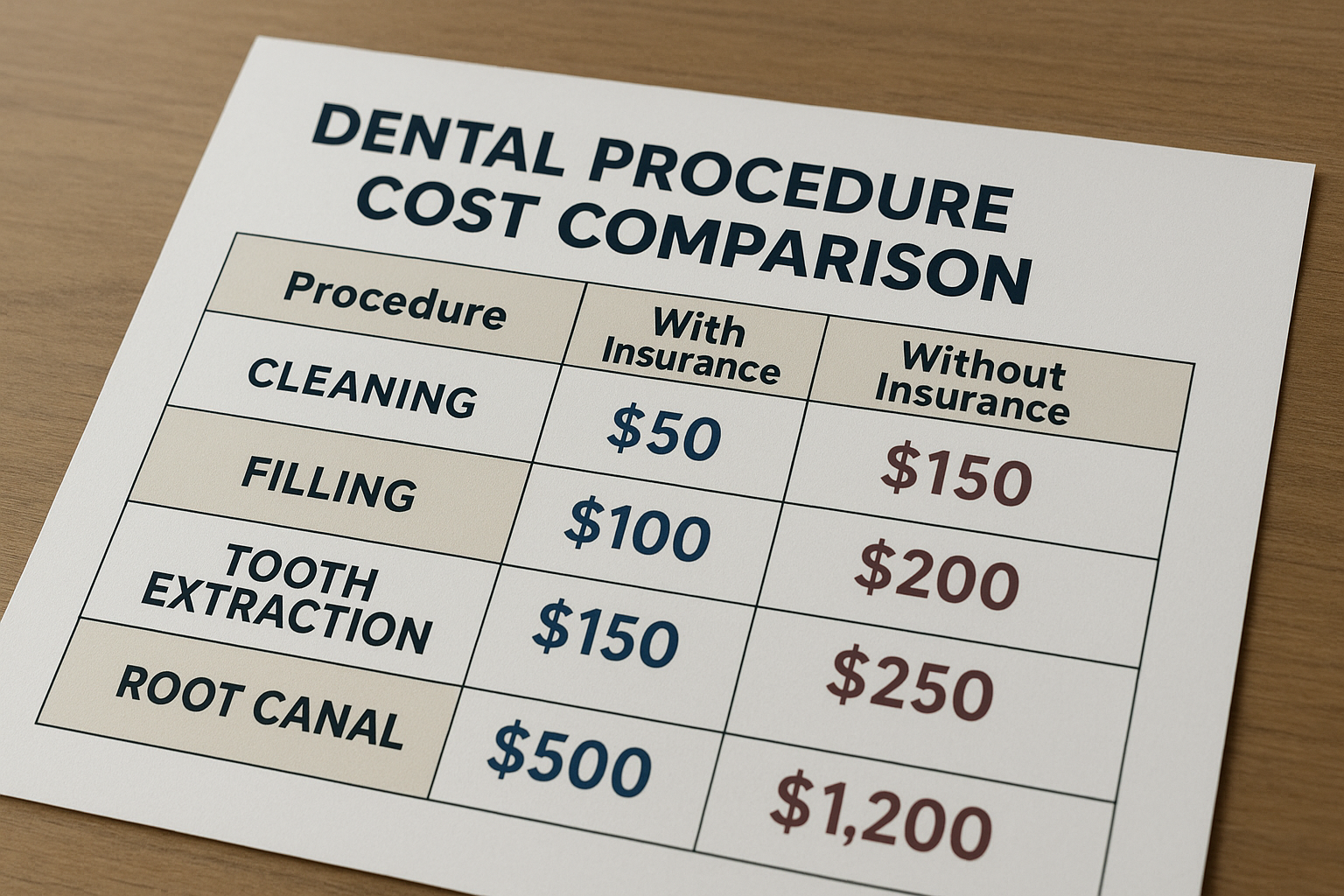

The financial implications of dental insurance can be significant. On average, Americans spend over $1,000 annually on dental care without insurance1. By investing in a dental plan, you can drastically reduce these costs. Many plans cover preventive care, such as cleanings and check-ups, at 100%, which helps prevent costly procedures in the future.

Furthermore, some insurance providers offer plans with no waiting periods for major procedures, allowing immediate access to necessary treatments. Searching for such options can result in substantial savings, especially for those requiring immediate dental work.

Evaluating Costs and Coverage

When selecting a dental plan, it's essential to evaluate both the monthly premium and the coverage provided. Premiums can range from $20 to $50 per month, depending on the plan type and level of coverage2. It's crucial to weigh these costs against potential savings on dental procedures.

Additionally, consider the annual maximum benefit, which is the maximum amount the plan will pay in a year. Many plans have a cap of $1,000 to $2,000, so it's important to choose a plan that aligns with your anticipated dental needs3.

How to Choose the Right Plan

Choosing the right dental insurance plan involves assessing your current and future dental needs. Consider the types of services you anticipate needing, such as orthodontics or periodontal treatments. Also, factor in whether your preferred dentist is within the plan's network.

By visiting websites that compare different dental plans, you can make an informed decision that maximizes your savings and ensures comprehensive coverage. Many online resources offer tools to compare plans side-by-side, making it easier to find the best fit for your budget and dental health requirements.

Ultimately, the right dental insurance plan can lead to significant savings and peace of mind. By exploring these options, you can secure a plan that offers both financial and health benefits, ensuring you maintain a healthy smile without breaking the bank.