Hedge Funds Hate These Real Estate Investment Strategies

Are you ready to uncover the real estate investment strategies that hedge funds wish you wouldn't explore, offering you untapped opportunities to browse options and potentially boost your financial portfolio?

Understanding Why Hedge Funds Dislike Certain Real Estate Strategies

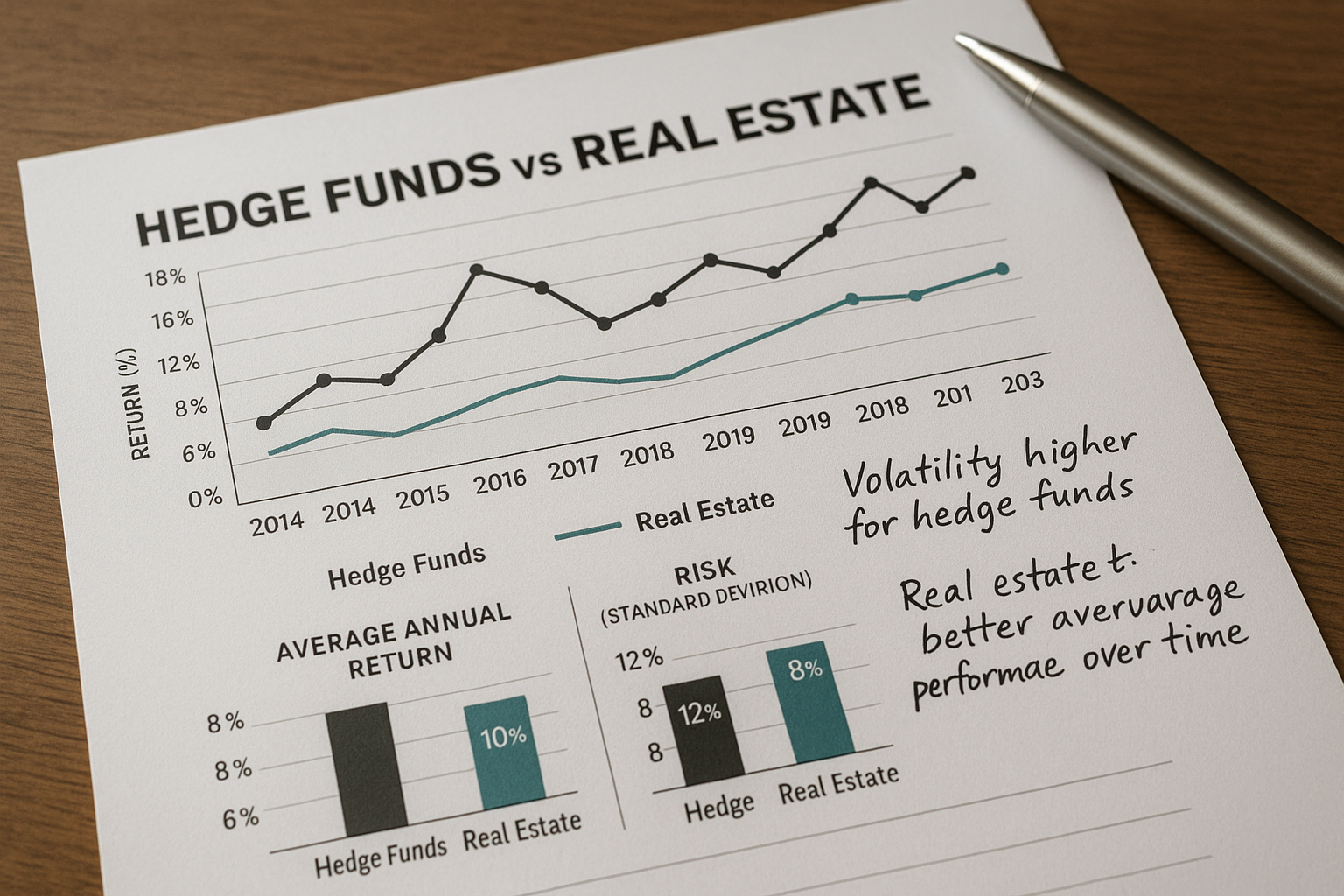

Hedge funds are known for their aggressive investment tactics and substantial financial clout. However, there are certain real estate investment strategies that these financial giants tend to avoid or overlook, often due to their preference for large-scale, high-return opportunities. For individual investors like you, this opens up a unique avenue to capitalize on strategies that might not align with the hedge funds' modus operandi but offer substantial benefits at a smaller scale.

Off-Market Properties: A Hidden Gem

Off-market properties are those not listed on the Multiple Listing Service (MLS), making them less visible to the general public and large investment firms. These properties can often be acquired at a lower cost, as sellers are typically motivated to close deals quickly. By focusing on off-market deals, you can bypass the competitive bidding wars that hedge funds often engage in, allowing you to secure properties at more favorable terms. To find these opportunities, you might consider visiting websites that specialize in off-market listings or connecting with local real estate agents who have insider knowledge.

Real Estate Crowdfunding: Democratizing Investment

Real estate crowdfunding platforms have democratized property investment, allowing individuals to invest in real estate projects with relatively small amounts of capital. This strategy is generally unattractive to hedge funds due to the smaller scale and the democratized nature of the investment, which doesn't align with their high-volume trading strategies. For individual investors, however, it provides a chance to diversify their portfolio and gain exposure to real estate without needing to purchase entire properties. You can search options on various crowdfunding platforms to find projects that align with your financial goals and risk appetite.

Investing in REITs for Steady Income

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without directly owning properties. They are known for providing steady income through dividends, making them appealing to individual investors seeking passive income streams. Hedge funds may shy away from REITs due to their preference for higher-risk, higher-reward investments. For you, investing in REITs can be a strategic move to enjoy the benefits of real estate investments with the liquidity and ease of stock trading. Explore various REITs to see these options and find ones that suit your investment strategy.

Short-Term Rentals: Maximizing Returns

The rise of platforms like Airbnb has made short-term rentals a lucrative option for property owners. While hedge funds typically focus on long-term rental income, individual investors can capitalize on the higher per-night rates offered by short-term rentals. This strategy requires more hands-on management but can yield higher returns, especially in tourist-heavy areas. If you're interested in this approach, consider searching for properties in high-demand locations and evaluating the potential income against traditional rental models.

By leveraging these real estate strategies that hedge funds often overlook, you can carve out a niche for yourself in the market and potentially achieve impressive returns. Explore the resources and options available to you, and take the first step toward enhancing your investment portfolio today.