Master Home Insurance Essentials Easily Today Save Big

If you're ready to demystify home insurance and potentially save a significant amount on your premiums, now is the perfect time to explore your options, browse available plans, and see these options that could help you safeguard your home while keeping costs low.

Understanding Home Insurance Essentials

Home insurance is a crucial aspect of homeownership, providing financial protection against unforeseen events like natural disasters, theft, and accidents. It's not just about safeguarding your property but also ensuring peace of mind. With the right knowledge, you can navigate this complex market and find a policy that fits your needs and budget.

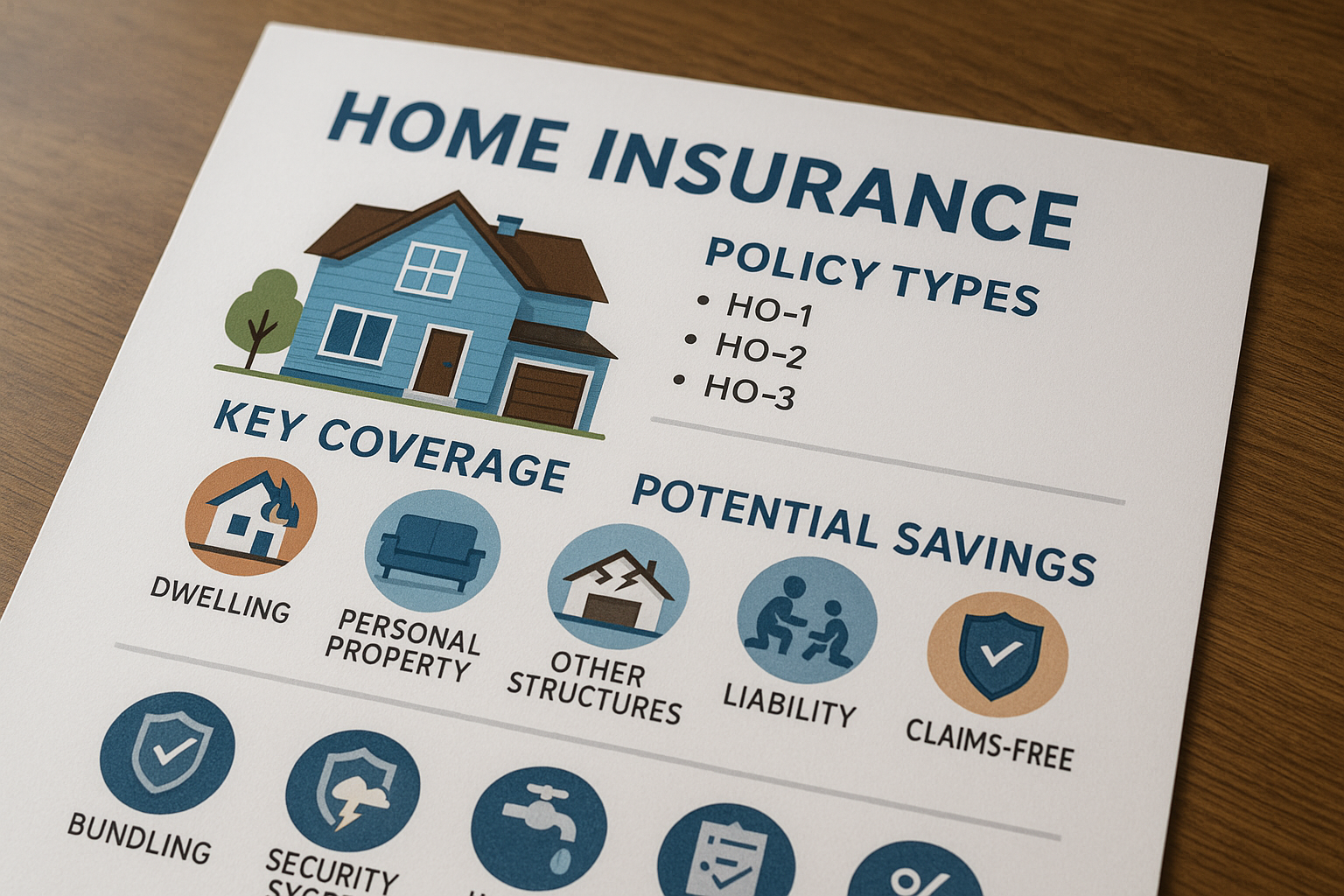

Types of Home Insurance Coverage

Home insurance policies typically cover several key areas:

1. **Dwelling Coverage**: This protects the structure of your home, including walls, roof, and built-in appliances. It's essential to have enough coverage to rebuild your home in case of total loss.

2. **Personal Property Coverage**: This covers your personal belongings, such as furniture, electronics, and clothing, against damage or theft. It's important to take inventory and estimate the value of your possessions to ensure adequate coverage.

3. **Liability Protection**: This offers coverage if someone is injured on your property and you are found legally responsible. It also covers legal fees and medical expenses.

4. **Additional Living Expenses (ALE)**: If your home becomes uninhabitable due to a covered peril, ALE covers the cost of living elsewhere temporarily.

Factors Influencing Home Insurance Costs

Several factors can affect the cost of your home insurance premium:

- **Location**: Homes in areas prone to natural disasters or high crime rates may have higher premiums.

- **Home Value and Construction**: The cost to rebuild your home, including materials and labor, influences your premium.

- **Deductible Amount**: A higher deductible can lower your premium, but you'll pay more out-of-pocket in the event of a claim.

Claims History**: A history of frequent claims can increase your premium.

Strategies to Save on Home Insurance

There are several actionable strategies to help you save on home insurance:

- **Bundle Policies**: Many insurers offer discounts if you bundle home and auto insurance policies.

- **Improve Home Security**: Installing security systems or smoke detectors can lead to premium discounts.

- **Shop Around**: By comparing quotes from different insurers, you can find competitive rates. Utilize online platforms to search options and compare policies.

- **Maintain a Good Credit Score**: Insurers often consider credit scores when determining premiums, so maintaining a good score can help reduce costs.

Real-World Data and Examples

According to the Insurance Information Institute, the average annual premium for homeowners insurance in the U.S. is approximately $1,3121. However, this can vary widely based on location and other factors. For instance, in states like Florida, where natural disasters are more common, premiums can be significantly higher2.

Exploring Specialized Solutions

If you have unique needs, such as high-value items or a home in a high-risk area, specialized insurance solutions are available. Many insurers offer customizable policies that can include additional riders for specific circumstances. By visiting websites of various insurers, you can explore these tailored options to ensure comprehensive coverage.

Mastering the essentials of home insurance not only protects your investment but also offers opportunities for substantial savings. By understanding the types of coverage, factors influencing costs, and strategies to reduce premiums, you can make informed decisions that align with your financial goals. Don't hesitate to follow the options and explore the various plans available to find the best fit for your needs.