Apartment Insurance Secrets Landlords Never Tell You

Unlocking the hidden truths about apartment insurance not only safeguards your property but also opens up a world of cost-effective strategies and expert insights—explore these options to ensure you're not missing out on the best deals and coverage.

Understanding Apartment Insurance

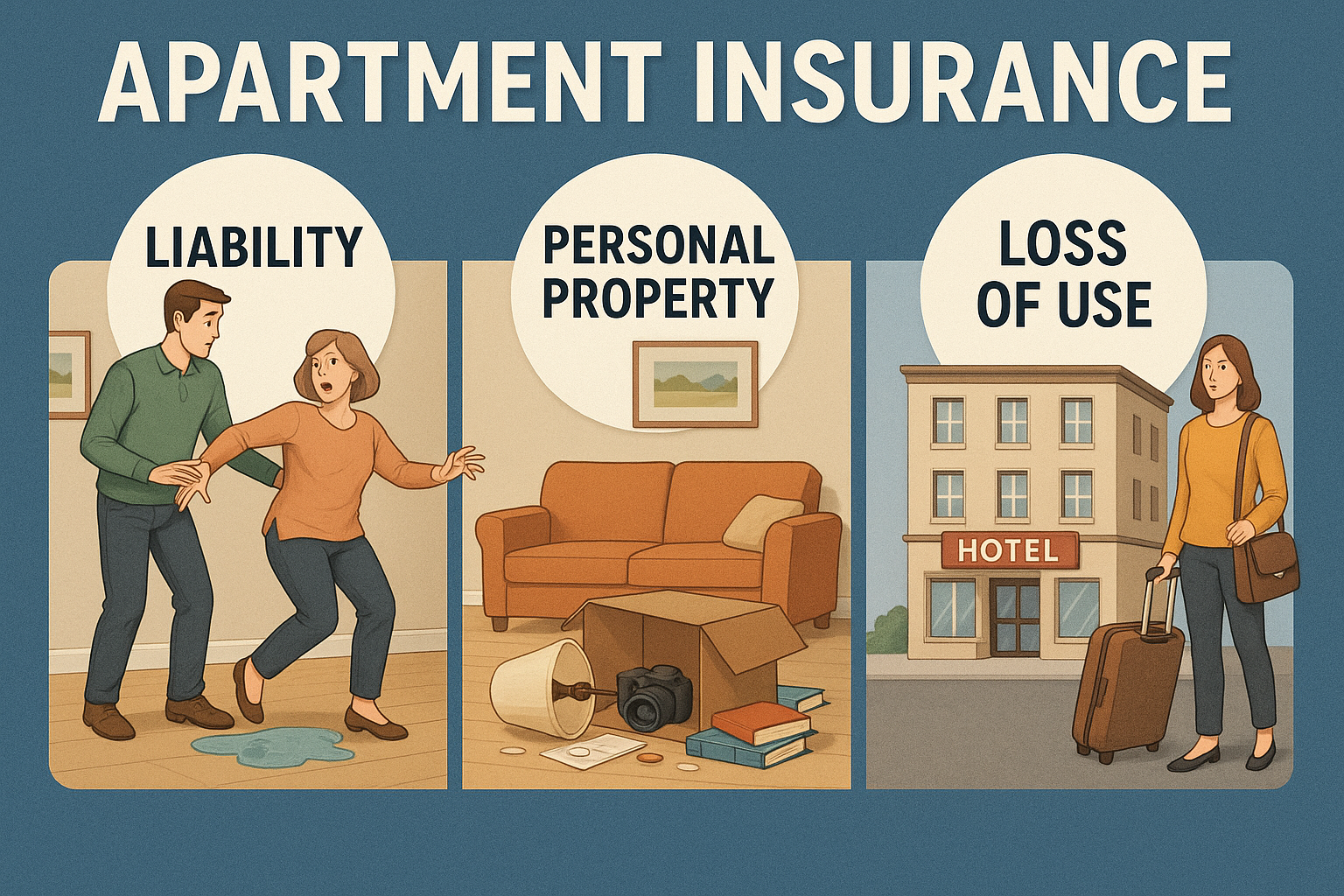

Apartment insurance, often referred to as landlord insurance, provides a safety net for property owners renting out their apartments. Unlike standard homeowner's insurance, this type of coverage is specifically designed to protect rental properties from unique risks associated with leasing to tenants. It typically covers the building structure, liability claims, and loss of rental income due to covered damages. Understanding the intricacies of these policies can help landlords make informed decisions, ensuring comprehensive protection while optimizing costs.

The Unspoken Benefits of Apartment Insurance

Many landlords overlook the full spectrum of benefits that apartment insurance can offer. Beyond the basic coverage, policies can be tailored to include additional protections such as vandalism, theft, and legal fees associated with eviction processes. Some insurers offer discounts for landlords with multiple properties or those who implement safety measures like smoke detectors and security systems1. By exploring these options, landlords can secure better rates and comprehensive coverage.

Cost Considerations and Savings Opportunities

The cost of apartment insurance varies significantly based on factors like location, property value, and coverage limits. On average, landlords can expect to pay between $500 and $2,000 annually for standard policies2. However, savvy landlords can reduce these costs by bundling policies, increasing deductibles, or qualifying for loyalty discounts. It's crucial to browse options and compare quotes from multiple insurers to ensure you're getting the best deal.

Liability Coverage: A Critical Component

Liability coverage is a crucial aspect of apartment insurance that protects landlords from legal claims arising from tenant injuries or property damage. This coverage can save landlords from potentially devastating financial losses. For instance, if a tenant sues for injuries sustained due to a maintenance issue, liability insurance can cover legal fees and settlements3. Ensuring adequate liability limits is essential for mitigating risks.

Loss of Rental Income Coverage

Another vital yet often overlooked feature of apartment insurance is coverage for loss of rental income. If a covered event, such as a fire or severe storm, renders the property uninhabitable, this coverage compensates landlords for the lost rental income during repairs4. This protection ensures financial stability and continuity in cash flow, making it an indispensable component of comprehensive coverage.

Exploring Specialized Coverage Options

For landlords managing unique properties or tenant situations, specialized coverage options are available. These include rent guarantee insurance, which protects against tenant default, and coverage for short-term rentals, such as those listed on platforms like Airbnb. By visiting websites of specialized insurers, landlords can find tailored solutions that address specific needs and enhance their overall protection strategy.

By delving into the often-unrevealed aspects of apartment insurance, landlords can not only protect their investments but also uncover opportunities for savings and enhanced coverage. As you navigate the complexities of insurance policies, remember to search options and explore specialized services to ensure your property—and your peace of mind—are well-protected.