Save Thousands Compare Employer Health Insurance Plans Now

Unlock the potential to save thousands on your business's healthcare costs by taking a proactive approach to compare employer health insurance plans now—browse options and discover the best fit for your company’s needs.

Understanding Employer Health Insurance Plans

Employer health insurance plans are a cornerstone of employee benefits, offering coverage that can significantly impact both your employees' well-being and your company's financial health. With rising healthcare costs, finding the right plan is crucial. By comparing different options, you can ensure that your business gets the best deal, providing comprehensive benefits while managing expenses effectively.

The Financial Impact of Choosing the Right Plan

Choosing the right health insurance plan can lead to substantial savings for your business. According to a study by the Kaiser Family Foundation, employer health insurance premiums have seen a steady increase, with the average annual premium for family coverage reaching $22,221 in 20231. By comparing plans, you can identify opportunities to reduce these costs through competitive pricing and tailored coverage options.

Key Factors to Consider When Comparing Plans

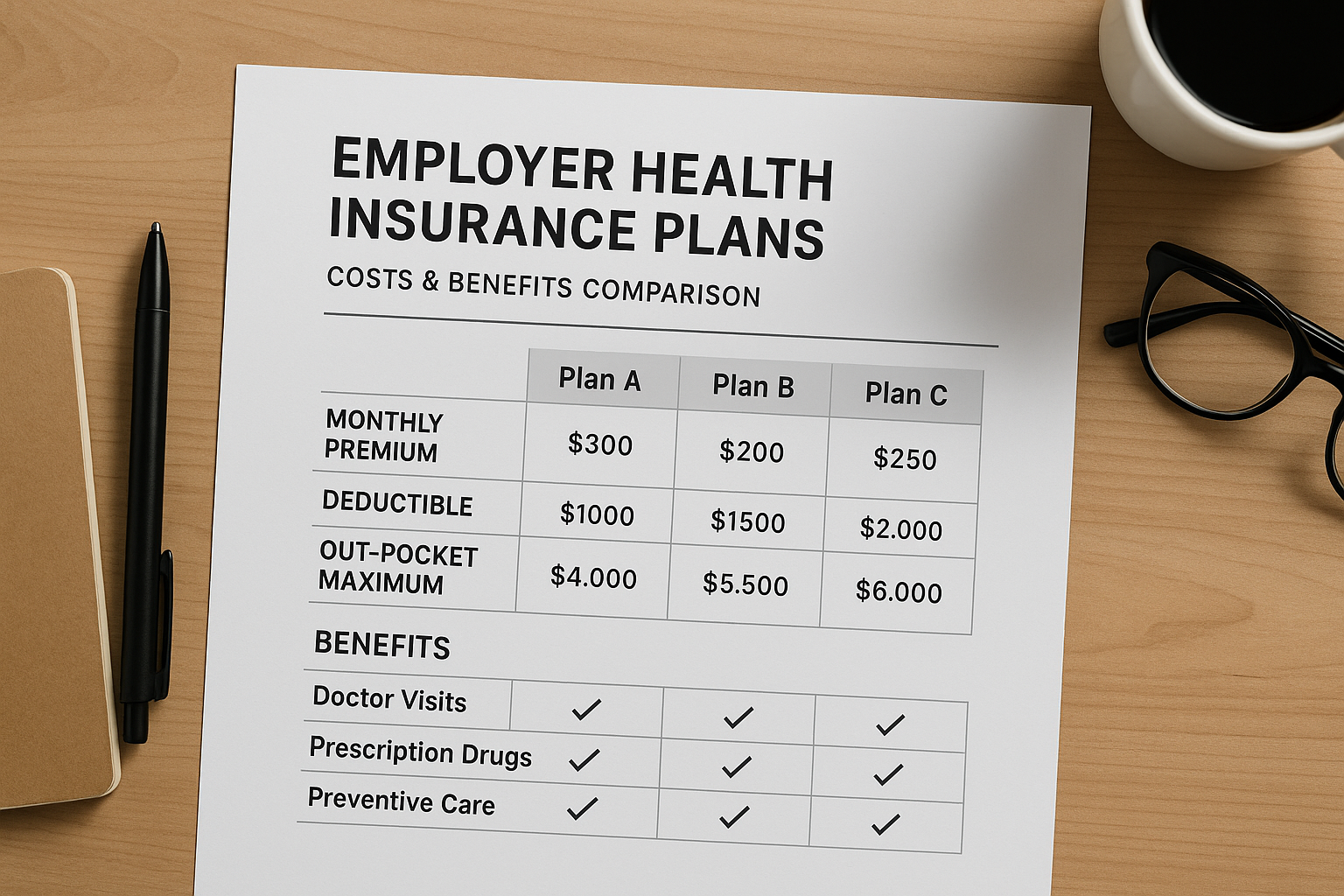

When evaluating health insurance plans, several factors should be taken into account:

- Coverage Options: Ensure the plan covers essential health benefits such as hospitalization, prescription drugs, maternity care, and mental health services.

- Network Availability: Check if the plan includes a wide network of healthcare providers, allowing your employees to access quality care without excessive out-of-pocket costs.

- Cost-sharing Requirements: Analyze deductibles, copayments, and coinsurance to understand the total cost burden on your employees.

- Flexibility and Customization: Look for plans that offer flexibility in terms of adding or removing specific benefits to better suit your workforce's needs.

Strategies for Maximizing Savings

Employers can employ several strategies to maximize savings on health insurance plans:

- Wellness Programs: Implementing wellness programs can reduce healthcare costs by promoting healthier lifestyles among employees, potentially leading to lower insurance premiums.

- Self-funding Options: For larger businesses, self-funding can be a cost-effective alternative, allowing employers to pay for claims directly rather than through fixed insurance premiums2.

- Health Savings Accounts (HSAs): Pairing high-deductible health plans with HSAs can provide tax advantages and encourage employees to make cost-conscious healthcare decisions.

Exploring Specialized Solutions

For businesses seeking specialized solutions, there are numerous resources available. Companies can explore tailored plans that cater to specific industries or workforce demographics. Additionally, consulting with insurance brokers or using online platforms can simplify the process of comparing plans and finding the best fit for your business3.

Taking the time to compare employer health insurance plans not only helps you save money but also ensures that your employees receive the best possible healthcare coverage. By understanding the various options and leveraging available resources, you can make informed decisions that benefit both your company and its workforce. As you explore these options, remember that a well-chosen health insurance plan is an investment in your business's future success.