Texas Homeowners' Secret to Lowest HELOC Rates Revealed

Unlocking the secret to the lowest HELOC rates in Texas can empower you to maximize your home's equity, and with the right knowledge, you can browse options that lead to significant financial savings.

Understanding HELOCs and Their Benefits

A Home Equity Line of Credit (HELOC) is a flexible loan option that allows homeowners to borrow against the equity of their home. This type of loan is particularly appealing due to its revolving credit line, which functions similarly to a credit card but typically offers lower interest rates. For Texas homeowners, securing a HELOC with the lowest possible rates can be a game-changer in managing finances, funding home improvements, or consolidating debt.

HELOCs offer several benefits, including interest-only payment options during the draw period, potential tax deductions on interest paid (consult with a tax advisor for eligibility), and the ability to borrow only what you need, when you need it. These features make HELOCs a versatile financial tool for homeowners looking to leverage their home equity effectively.

Factors Affecting HELOC Rates

The interest rates on HELOCs can vary based on several factors, including the prime rate, the borrower's credit score, and the loan-to-value (LTV) ratio of the home. In Texas, the real estate market's stability and growth have contributed to competitive HELOC rates, but individual rates will still depend on personal financial circumstances and the lender's criteria.

Improving your credit score is one of the most effective ways to secure a lower HELOC rate. Lenders typically offer better rates to borrowers with higher credit scores, as they are seen as less risky. Additionally, maintaining a low LTV ratio can also help in obtaining favorable terms. This ratio represents how much of the home's value is being borrowed and is calculated by dividing the loan amount by the appraised value of the property.

Strategies for Securing the Best Rates

To secure the best HELOC rates in Texas, consider the following strategies:

- Shop Around: Different lenders offer varying rates and terms, so it's crucial to compare offers from multiple financial institutions. Visit websites of banks, credit unions, and online lenders to find the most competitive rates available.

- Negotiate Terms: Don't hesitate to negotiate with lenders. They may be willing to offer better rates or waive certain fees to secure your business.

- Consider Introductory Rates: Some lenders offer low introductory rates for a set period. These can be beneficial if you plan to repay the loan quickly.

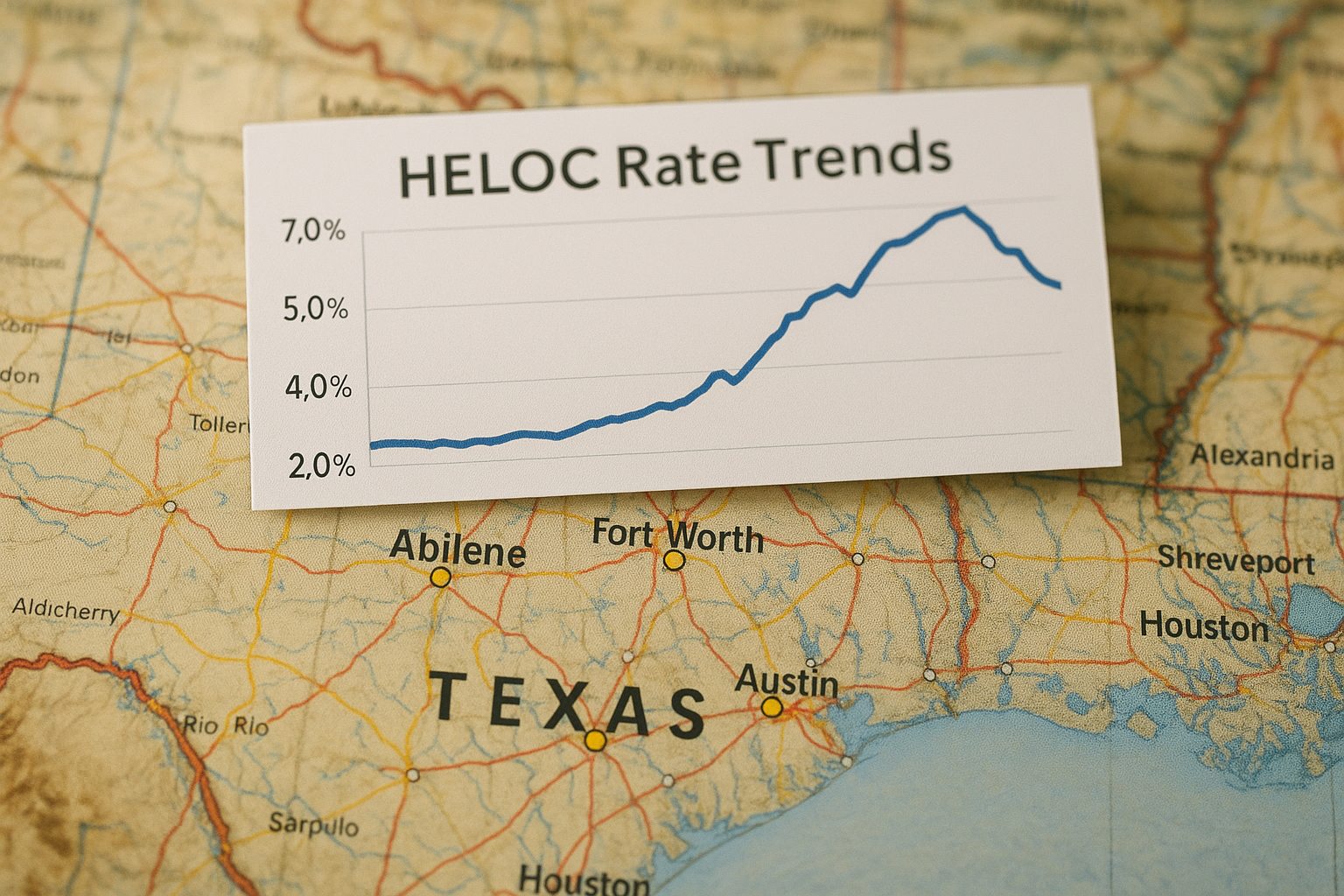

Current Market Trends and Offers

As of late 2023, Texas remains a favorable market for HELOCs due to its robust housing market and competitive lending environment. Many lenders are offering promotional rates as low as 3.5% for qualified borrowers, although these rates are subject to change based on market conditions1. Additionally, some lenders are providing incentives such as waived application fees or discounted closing costs, which can further reduce the overall cost of borrowing.

Exploring Further Options

For those interested in exploring more tailored solutions, specialized financial advisors or mortgage brokers in Texas can provide personalized guidance and access to exclusive deals that may not be widely advertised. By following the options available through these professionals, you can ensure that you are making the most informed decision possible.

Ultimately, securing the lowest HELOC rates in Texas involves understanding your financial position, staying informed about market trends, and actively engaging with lenders to find the best available terms. As you navigate this landscape, remember to explore the various resources and options highlighted throughout this article to optimize your financial strategy.