Colorado's Secret Path to Credit Strength Unveiled

Unlocking the secrets of boosting your credit strength in Colorado can open doors to financial freedom and savvy investment opportunities, so don't miss the chance to browse options that could transform your financial future today.

Understanding Colorado's Unique Credit Landscape

Colorado offers a distinctive approach to building and maintaining credit strength, largely due to its thriving economy and supportive financial community. The state's economic environment, characterized by a robust job market and a high median income, provides a solid foundation for residents looking to enhance their credit profiles. With the right strategies, Coloradans can leverage these advantages to achieve remarkable credit scores, which in turn can lead to lower interest rates on loans, better insurance rates, and even improved job prospects.

Steps to Strengthen Your Credit in Colorado

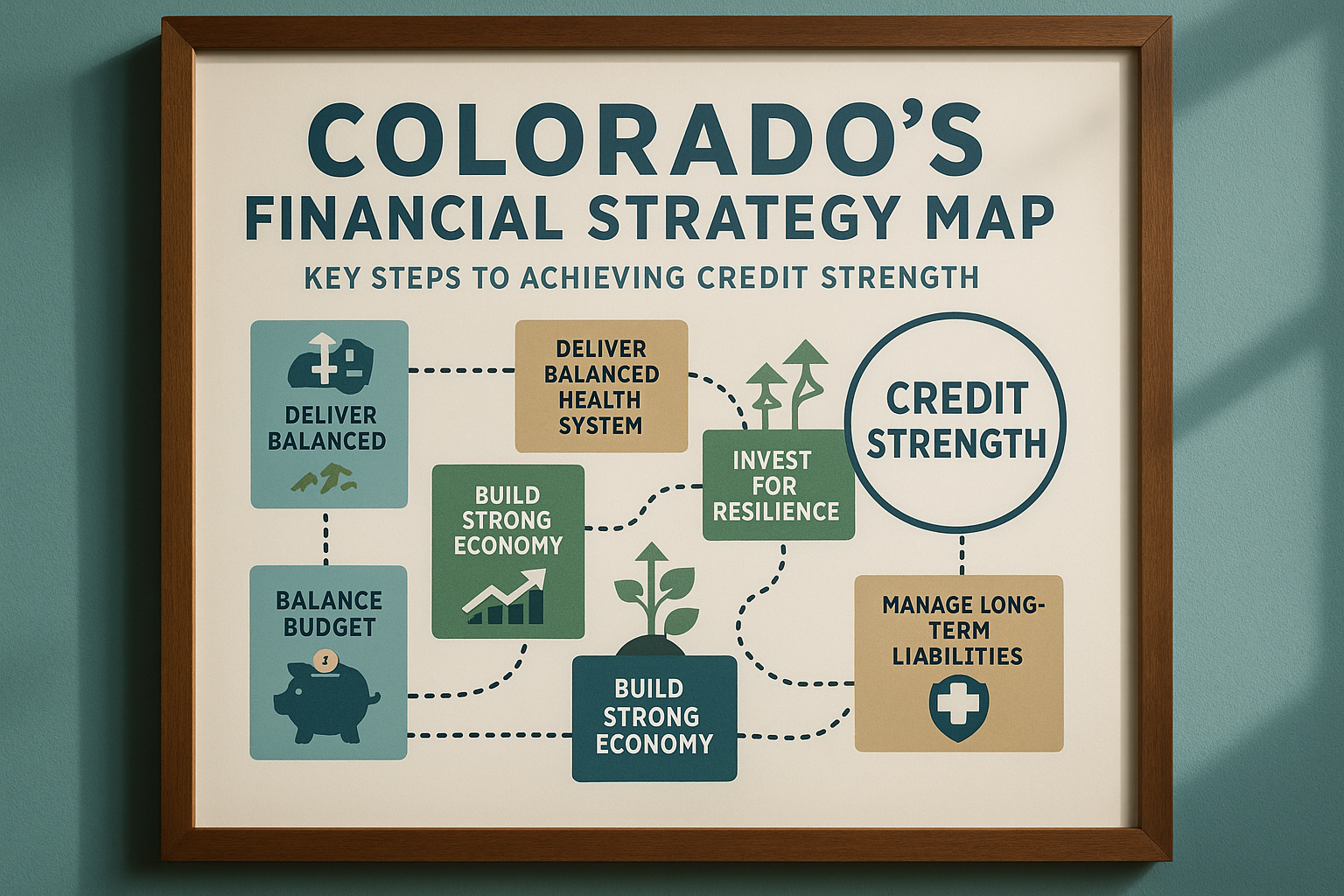

One of the first steps to improving your credit score is understanding the factors that influence it. In Colorado, like elsewhere, your credit score is affected by your payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries. By focusing on these areas, you can take actionable steps toward credit improvement.

1. **Timely Payments**: Ensure all bills, especially credit card payments, are made on time. Late payments can significantly impact your credit score.

2. **Credit Utilization**: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit limit.

3. **Diverse Credit Portfolio**: Having a mix of credit accounts, such as credit cards, installment loans, and retail accounts, can positively impact your score.

4. **Regular Credit Monitoring**: Utilize credit monitoring services to keep track of your credit score and report. This allows you to quickly address any inaccuracies or fraudulent activities.

Leveraging Colorado's Financial Resources

Colorado residents have access to a plethora of financial resources that can assist in credit building. Numerous credit unions and community banks offer credit-building loans and secured credit cards tailored to those looking to enhance their credit scores. These financial products are specifically designed to help individuals establish or rebuild credit by reporting consistent, positive payment activity to credit bureaus.

Additionally, financial literacy programs are widely available throughout the state, providing education on budgeting, saving, and responsible credit use. These programs often partner with local organizations to offer workshops and one-on-one counseling sessions to help individuals develop effective credit management skills.

The Impact of a Strong Credit Score

A strong credit score in Colorado can have far-reaching benefits. For instance, it can lead to more favorable terms when securing a mortgage, car loan, or personal loan. According to recent data, individuals with higher credit scores can save thousands of dollars in interest over the life of a loan1. Furthermore, many employers in Colorado consider credit scores as part of their hiring process, particularly for positions involving financial responsibilities2.

For those looking to make significant financial investments, such as purchasing property in Colorado's competitive real estate market, a solid credit score is essential. It not only increases the likelihood of loan approval but also provides leverage in negotiating better mortgage rates.

Exploring Additional Resources

For individuals eager to delve deeper into credit improvement strategies, numerous online platforms offer tools and resources tailored to Colorado residents. Websites like Credit Karma and Experian provide free credit reports and personalized advice on credit enhancement34. These platforms can be invaluable for tracking progress and identifying areas for improvement.

By taking advantage of Colorado's unique economic opportunities and financial resources, you can significantly strengthen your credit profile. Whether you're aiming to secure a loan, reduce insurance costs, or enhance your employment prospects, a robust credit score is a powerful asset. Take the initiative today to explore the various options and resources available to you, and watch as your financial possibilities expand.