Transform Finances Today With Hidden Mittelstand Bonds Secrets

Unlock the potential of your financial future by exploring the often-overlooked world of Mittelstand bonds, where you can browse options that promise stability and growth in an unpredictable market.

Understanding Mittelstand Bonds

Mittelstand bonds are financial instruments issued by small and medium-sized enterprises (SMEs) primarily in Germany. These bonds are part of the broader Mittelstand, a term that refers to the backbone of the German economy, characterized by family-owned businesses that focus on long-term growth and sustainability. By investing in these bonds, you gain access to a sector known for its resilience and innovation, offering a unique opportunity to diversify your investment portfolio.

Benefits of Investing in Mittelstand Bonds

One of the primary benefits of Mittelstand bonds is their potential for higher returns compared to traditional government or corporate bonds. SMEs often provide attractive interest rates to compensate for the higher perceived risk. Additionally, these bonds offer the chance to support companies that are crucial to economic growth, fostering job creation and technological advancements.

Investors can also enjoy relatively low correlation with global stock markets, making Mittelstand bonds an excellent hedge against market volatility. This diversification can be particularly beneficial during economic downturns, as SMEs tend to be more agile and adaptable than larger corporations.

Risks and Considerations

While Mittelstand bonds present compelling opportunities, they are not without risks. The primary concern is the financial stability of the issuing company. SMEs may be more susceptible to economic fluctuations, and their smaller size can make them vulnerable to market changes. It's crucial to conduct thorough due diligence before investing, examining the company's financial health, management team, and industry position.

Additionally, Mittelstand bonds are less liquid than larger corporate bonds, which means they may be harder to sell quickly if needed. Potential investors should be prepared for a longer investment horizon and consider their liquidity needs before committing funds.

Real-World Examples and Data

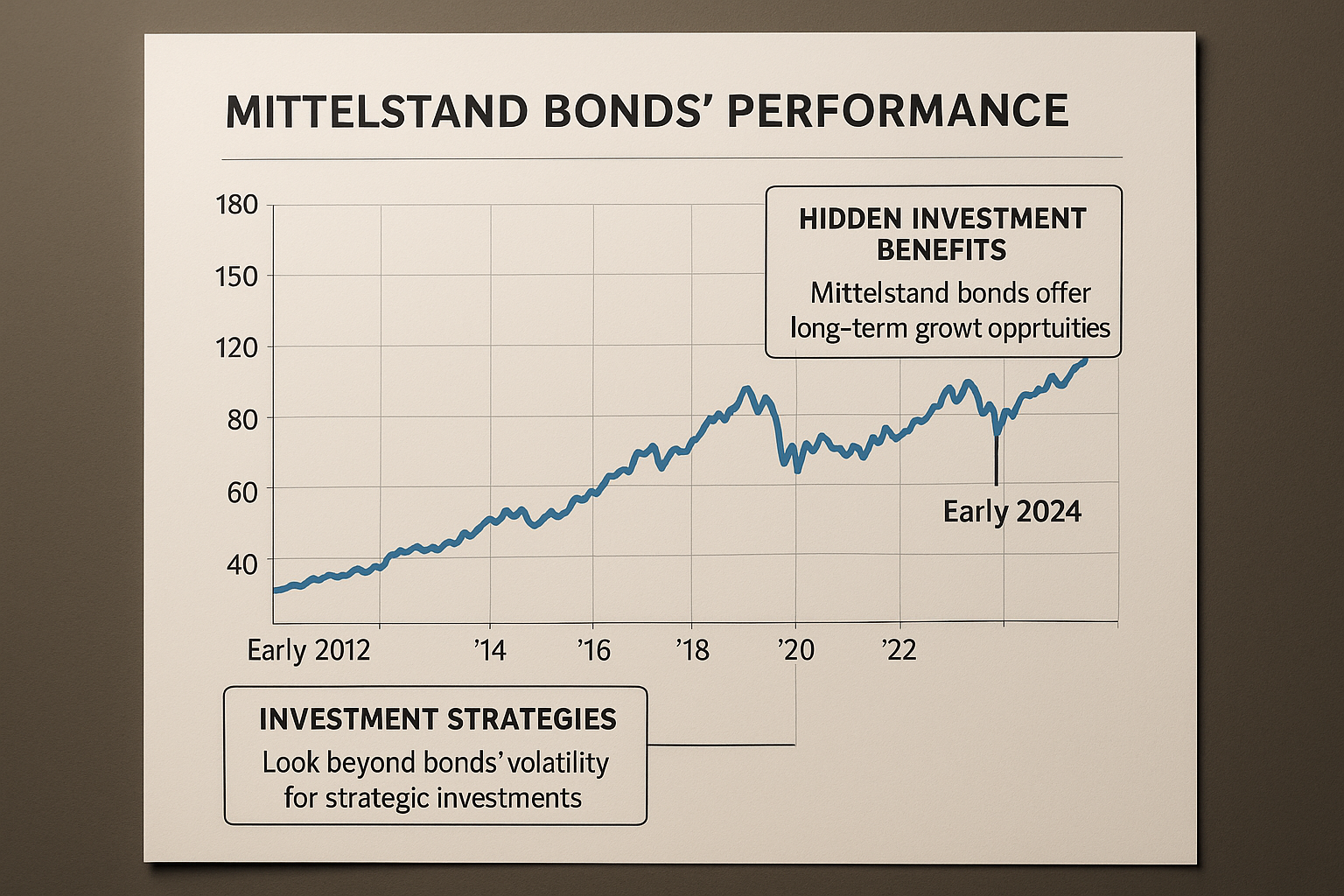

The Mittelstand sector has been instrumental in Germany's economic success, contributing approximately 52% of the country's GDP and employing over 60% of the workforce1. This strong foundation underscores the potential stability and growth opportunities associated with Mittelstand bonds.

For instance, a study by the German Economic Institute highlighted that SMEs in the Mittelstand sector showed a 3% annual growth rate over the past decade, outpacing many larger corporations2. This growth is indicative of the sector's robust performance, even during challenging economic periods.

Exploring Investment Options

For those interested in Mittelstand bonds, there are several avenues to explore. Specialized investment platforms and financial advisors can provide tailored advice and access to a curated selection of bonds. It's advisable to visit websites of financial institutions that focus on SME investments or search options that offer comprehensive analyses and market insights. These resources can guide you in selecting bonds that align with your financial goals and risk tolerance.

Investing in Mittelstand bonds offers a unique opportunity to diversify your portfolio while supporting the vital SME sector. With potential for higher returns and reduced market correlation, these bonds can be a strategic addition to your investment strategy. As you explore the myriad options available, consider the stability and growth potential that Mittelstand bonds bring to the table, and follow the options that align with your financial aspirations.